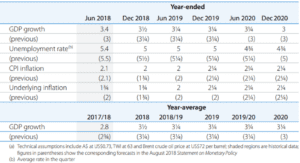

The Australian economy is headed for another strong year – GDP growth is expected to average 3.5% in 2019. But the housing downturn, coupled with slow growth in household incomes, will continue to be a drag on the economy.

In its latest Statement on Monetary Policy, the Reserve Bank of Australia (RBA) is upbeat about the economy’s prospects in 2019. It expects the nation’s unemployment rate to trend below 5% and inflation to pick up to 2.25% – well within its target range of 2%–3%.

The RBA says that accommodative monetary policy – that is, keeping official interest rates at a record low of 1.5% – and the strengthening labour market will support growth in household income and consumption. It also expects investment in public infrastructure to help shore up the economy.

Figure 1: Australian output growth and inflation forecasts (%)

Slow growth in household income and wages

Household income and wealth continue to create uncertainty for the economy, according to the RBA. Although growth in household incomes has risen slightly since early 2017 to reach 3% in June 2018, the pace remains sluggish.

The RBA is banking on increases in income to drive household consumption, but wage growth is expected to remain slow.

“The Board is continuing to assess the impact of slow growth in household incomes in an environment of high debt and declines in housing prices,” says the RBA.

The bank acknowledges that recent falls in housing prices will weigh on household wealth. But it appears uncertain as to whether these declines will affect household consumption.

More price falls coming

While the RBA doesn’t seem overly concerned about the housing market, economists continue to warn about further falls in home values and the potential impact on the economy.

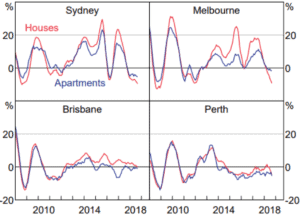

National housing values fell 0.5% in October 2018, bringing the annual decline in house prices to 3.5%, according to CoreLogic. Nearly all predictions by economists point to a continuing decline throughout 2019. Their only point of divergence is how much prices will tumble.

Economists at ANZ expect national home values to ease 2% in 2019, led by falls in Sydney and Melbourne. They forecast prices in these cities to fall by around 10% from peak to trough, with Sydney performing slightly worse than Melbourne.

AMP chief economist Shane Oliver has a more dire prediction. From his previous forecast of 15% price drops in Sydney and Melbourne, he now expects declines in these markets to reach 20% from peak to trough. Oliver identifies tightening credit conditions, a surge in housing supply and negative investor sentiment as likely drivers of these declines.

Figure 2: Housing price growth (six-month-ended annualised)

Morgan Stanley has also revised its forecast for national housing values. The investment bank now predicts prices to slump by 10%–15% from peak to trough, up from its previous projection of a 5%–10% decline.

“We struggle to see improvement in any of our components over the next year, with pre‑existing headwinds of net supply, an RBA on hold and sustained focus on lending standards, all independent of potential negative gearing/capital gains tax changes,” says Morgan Stanley in a recent report.

Oliver expects that a 20% slump in Sydney and Melbourne home prices will lead to a slowdown in housing construction and credit growth, and potentially impact household consumption. But this will be offset by strong infrastructure spending and business investment. As a result, economic growth will likely range between 2% and 3%, according to Oliver.

Dominating the landscape

Economists have largely attributed the housing downturn to tighter credit conditions due to the stricter lending policies of the Australian Prudential Regulation Authority (APRA).

Because APRA is unlikely to backtrack on these policies, housing credit conditions are expected to remain tight. This, together with a surge in supply and tepid demand from housing investors, will see housing prices dominate the domestic economy in the next 12 months.