Mortgage interest rates are going up as lenders struggle to absorb their rising funding costs, which partly drive the rates on loans. Despite no change in the official cash rate as of July 2018, smaller lenders have started hiking interest rates on home loans – and the major banks are expected to do the same soon.

Increases in home loan rates are expected to add to the financial burden of Australian households, many of which are already struggling with high levels of debt and weak wage growth.

Lenders have increased rates since March 2018, when the Bank Bill Swap Rate (BBSW) – a benchmark short-term interest rate against which banks borrow – surged and started causing margin pressures on some lenders. Changes in the BBSW affect the wholesale funding costs of banks. The short-term bank funding spread rose to about 60 basis points in June – three times higher than the historical average, according to a recent analysis by Citi.

Smaller lenders feel the pressure of the rising BBSW more than their larger counterparts as they have less buffer to absorb rising funding costs, according to Citi’s Head of Australian Banks Research, Brendan Sproules. This explains why many of these lenders have already hiked their mortgage rates. But it doesn’t mean that the major banks – National Australia Bank, Commonwealth Bank, ANZ and Westpac – will continue absorbing funding costs for much longer.

“The major banks are facing similar pressures and are now expected to follow suit,” Sproules said. “We are expecting announcements by September, to shore up FY19 earnings expectations.”

Sproules expects these banks to “tread carefully” and hike rates by about 8 basis points on average across their mortgage portfolios by September. “Further repricing will likely be required in 2019 should the spike sustain.”

Smaller lenders raise rates

The Bank of Queensland and Auswide Bank are among the smaller lenders that have recently increased interest rates on a range of home loans. The Bank of Queensland raised its variable home loan rates by as much as 0.15%, effective July. It said in a statement that funding costs have significantly risen since February and have been driven by an increase in 30- and 90‑day BBSW rates.

Auswide Bank hiked its rates in June by 0.05% for owner-occupier home loans and 0.13% for investment home loans. The decision followed a sustained increase in 30- and 90-day BBSW levels, according to the company.

Average rate increases in June ranged from 0.08% for residential principal and interest loans to 0.27% for residential interest-only loans, according to Steve Mickenbecker, Group Executive of Financial Services at financial comparison site Canstar. “In June, Canstar saw increases in variable interest rates – the litmus test for lenders’ view of their future funding expectation and the rate that has an impact on existing as well as new customers,” he said.

Impact on mortgage holders

Public policy think tank the Grattan Institute warned in March that an increase of more than a few percentage points in mortgage rates would seriously impact all income groups. A 2 percentage point increase would be “catastrophic” for most new homeowners, said the institute’s chief executive, John Daley.

High levels of household debt and sluggish wage growth only add to this potential predicament. Around three in 10 Australian households in 2015–16 were ‘over-indebted’ based on the ratio of debt to income or assets, according to Australian Bureau of Statistics (ABS) data. Over-indebted households were more than twice as likely as other indebted households to have a home loan. Property debt of households rose from $78,400 in 2003–04 to $149,600 in 2015–16.

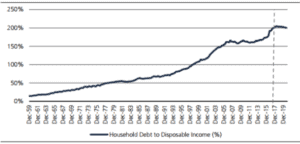

Recent estimates show that total household debt reached $2.466 trillion in 2017 – after the ABS started including mortgage debt held by self-managed super funds in its calculation of total household liabilities. This put the household-debt-to-income ratio at 200%, according to a UBS estimate.

Figure 2: Ratio of household debt to disposable income

As rates on their home loans start going up, mortgage holders are finding that they have little to no recourse to their wages. Wages have remained largely stagnant, growing only 0.5% in the first quarter of 2018 and 2.1% year on year, ABS data shows.

Reserve Bank of Australia Governor Philip Lowe has said that increases in wages of about 2% – down from 3% to 4% – have become the norm and that the sustained low wage growth has reduced Australia’s “sense of shared prosperity”.

“While low growth in wages has helped boost employment, it has also put the finances of some households under strain, especially those who borrowed on the basis that their income would grow at the old rate,” said Lowe.