After last year’s off-the-mark forecasts, it’s tough to predict with certainty where the housing market is going next, especially as factors such as interest rates and new policy measures come into play. But what’s clear is that prices aren’t likely to fall sharply in the coming months. They still have room to grow before they start to level out.

In this month’s Finder RBA Cash Rate Survey, 38 economists and other experts predict Sydney’s house prices will rise 8%, or more than $102,000 on average, by the end of 2022. Their forecast for Melbourne was higher at 9%, taking the average house price there to $954,800.

Nationally, Westpac expects dwelling values to grow 8% in 2022, up from its previous forecast of 5%.

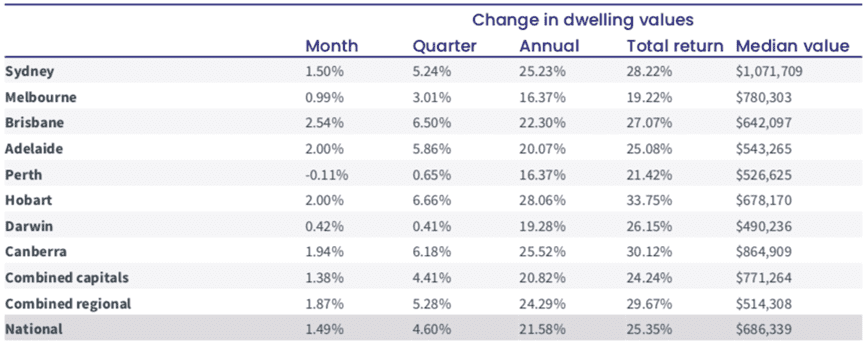

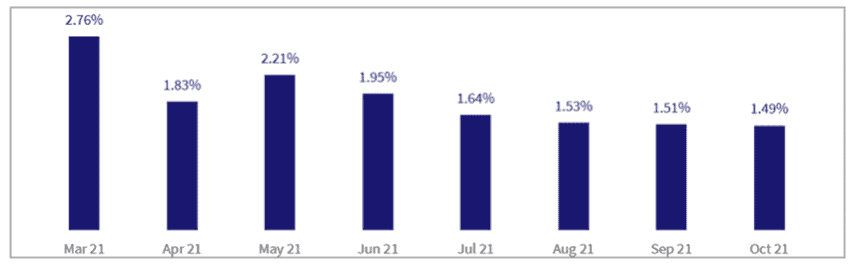

But the housing market is slowly losing momentum since reaching a monthly peak of 2.8% growth last March, according to CoreLogic Research Director Tim Lawless. Prices eased to 1.49% in October from 1.51% the previous month, which Lawless attributes to a lack of affordability, rising supply and waning government stimulus.

Figure 1: Change in Australian housing values, October 2021

Source: CoreLogic, Hedonic Home Value Index, October 2021

Figure 2: Monthly growth rate in Australian housing values

Source: CoreLogic, Where have monthly value changes fallen the most?

“Housing prices continue to outpace wages by a ratio of about 12:1,” he says. “This is one of the reasons why first homebuyers are becoming a progressively smaller component of housing demand. New listings have surged by 47% since the recent low in September, and housing-focused stimuluses such as HomeBuilder and stamp duty concessions have now expired.

“Combining these factors with the subtle tightening of credit assessments set for November 1, and it’s highly likely the housing market will continue to gradually lose momentum.”

Starting this month, banks must assess new borrowers’ ability to pay back loans at an interest rate that’s at least 3 percentage points higher than a loan’s rate. Observers largely see this as the beginning of a new credit tightening cycle as the Australian Prudential Regulation Authority (APRA) fears the growing housing debt might pose risks to the broader economy.

“In taking action, APRA is focused on ensuring the financial system remains safe, and that banks are lending to borrowers who can afford the level of debt they are taking on – both today and into the future,” said APRA Chair Wayne Byres in announcing the new rules.

Rising risks

Looking ahead, Lawless sees growing downside risks for the housing market. These include a further tightening in credit policy and the possibility of an early hike in the cash rate, on top of worsening affordability and increasing housing supply.

The Reserve Bank kept the official cash rate at 0.1% this month but is now predicted to raise it earlier than 2024, as previously expected. Economists such as those from Commonwealth Bank and AMP Capital have forecast that the cash rate will rise as early as November 2022.

“Once interest rates start to lift, there is a strong chance that housing prices will head in the opposite direction soon after,” says Lawless in a separate report.

Banks have in fact already started raising their mortgage rates, a move that could temper demand for housing. Data from RateCity shows that in October alone, 26 lenders raised at least one fixed rate.

“The fixed rate hikes are now coming thick and fast and they’re getting bigger as we go,” says RateCity Research Director Sally Tindall.

“The mortgage market is undergoing a transformation and it’s happening faster than expected. The speed at which global economies are improving has seen the cost of buying funds spike, putting pressure on banks to lift fixed rates.”

Working with a partner

As banks tighten their credit assessment, it’s even more important to work with a partner who understands the mortgage market well. A mortgage broker can help borrowers, including small business owners, to navigate changing lending requirements to ensure they get the solution that best meets their needs.