The Australian Prudential Regulation Authority (APRA) is relaxing the reins on investor property lending as housing credit growth slows and lending standards improve. But more restrictions are coming, and they are expected to slow credit growth further and potentially lead to falls in property values.

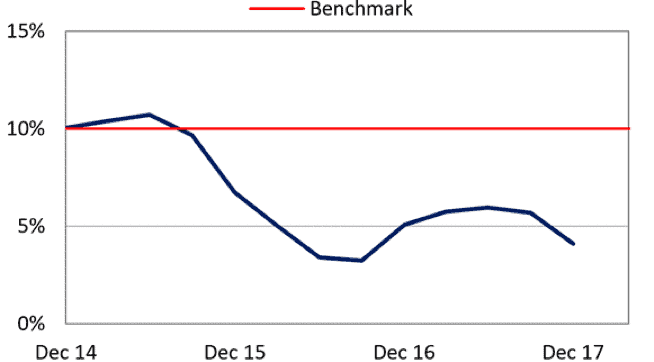

APRA announced in April that it would scrap the 10% cap on investor loan growth for lenders that could show they have been following the regulator’s guidelines. The cap limits the annual increase in property loans a lender issues to investors.

APRA Chairman Wayne Byres said the benchmark has served its purpose. “Lending growth has moderated, standards have been lifted and oversight has improved,” he said.

From 1 July 2018, the benchmark will no longer apply to lenders that have been operating below the cap for at least the past six months. Their boards will also have to assure APRA that their lending policies meet the serviceability guidelines, and that they will bolster lending practices where necessary.

APRA introduced the 10% limit in December 2014 as investor property lending soared amid cheap credit and housing booms in major cities. It designed the cap as a temporary measure to reduce higher-risk lending and improve practices.

Smaller lenders criticised the benchmark for curbing competition. Some of them had to stop issuing new property investor loans to remain within the threshold.

However, according to Byres, the move has led lenders to take steps to improve their quality of lending and to increase the resilience of their balance sheets.

“There has been a clear reduction in higher-risk lending, with investor loan growth moderating, interest-only lending declining and high loan-to-valuation lending also markedly lower,” said Byres. He also noted improvements in lending policies.

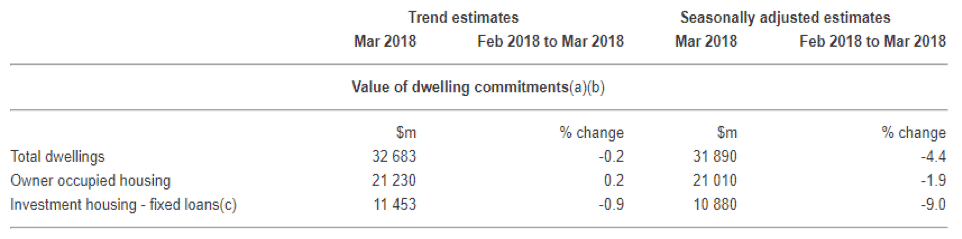

Property investor loans have grown well below the 10% limit over the past two years. Their value has also been decreasing. Data from the Australian Bureau of Statistics (ABS) shows that the value of investor housing loans dropped by 9% to $10.88 billion in March 2018 – the largest monthly decline since September 2015.

Figure 1: Year-on-year investor loan growth (%)

Figure 2: Estimates of the value of housing loans, March 2018

New limits

While standards have improved, Byres said the lending environment “remains one of heightened risks and there are still some practices that need to be further strengthened”.

APRA said more needs to be done to strengthen the assessment of borrowers’ expenses and existing debt and the oversight of lending outside of formal policies. It expects lenders to put in place:

- internal portfolio limits on the proportion of new lending at very high debt-to-income levels

- policy limits on maximum debt-to-income levels for individual borrowers.

“This provides a simple backstop to complement the more complex and detailed serviceability calculation for individual borrowers, and takes into account the total borrowings of an applicant, rather than just the specific loan being applied for,” said APRA.

Potential impact

J.P. Morgan economists Ben Jarman and Henry St John expect limits on high debt-to-income loans to significantly affect credit growth over the medium term. They said in a note that based on data from APRA, about 10% of new loans had a loan-to-income ratio of more than six times borrowers’ income. They estimated that these loans accounted for about 31% of the value of new property loans in recent years.

Restricting high debt-to-income loans would slow credit growth, which could lead to further falls in property values, said Jarman and St John.

They expect the limits to likely apply only to new loans: “While policymakers see an urgent need to stabilise household leverage, the official focus is on limiting risk in new housing exposures, with the regulator showing little appetite to tighten conditions on existing loans.”