The rising cost of borrowing and reduced consumer demand are hitting small and medium-sized enterprises (SMEs) hard. Payment defaults among them have surged to a record high, making them more vulnerable to business failure.

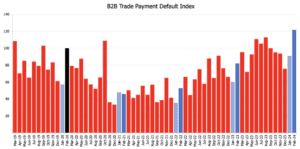

According to the latest CreditorWatch Business Risk Index (BRI), business-to-business trade payment defaults are now above pre-COVID levels and rose by almost 48% in February compared to the previous year.

The report found that businesses with a single default have a 24% likelihood of becoming insolvent within the next year. This probability increases to 42% for businesses with two defaults.

“An increasing number of businesses have less cash coming in, which means they are then finding it more difficult to pay their own suppliers, and as such, we are seeing a steep increase in payment defaults being registered on the CreditorWatch database,” says CreditorWatch CEO Patrick Coghlan.

“They are also cutting the size of their orders and running down inventories.”

Figure 1: Business-to-business trade payment default index

Source: CreditorWatch Business Risk Index

Falling invoice values

Adding to this challenge is a simultaneous decline in invoice values, which suggests that the 2023 slowdown in consumer spending has had a trickle-down effect on the broader Australian economy.

Coghlan believes the combination of rising business-to-business payment defaults and falling invoice values is highly concerning. “This indicates that cash reserves are being depleted and margins are being squeezed,” he adds.

Although data from CreditorWatch showed a seasonal increase in the average invoice value from January to February this year, overall values continue to decline. They currently sit 16% below the February 2023 level, marking their lowest point since September 2023.

F&B firms are most vulnerable

Businesses in the food and beverage services sector have the highest risk of business failure, with public administration and safety, as well as accommodation, following closely behind.

By geography, the regions with the highest risk of business failure are found in Western Sydney and South-East Queensland. Areas with the lowest risk are concentrated in regional Victoria, inner-Adelaide and North Queensland.

Rising external administrations

With many SMEs’ cash reserves depleted and margins squeezed, CreditorWatch data shows that the rate of external administrations is now well above pre-COVID levels. It has risen by more than 24%, compared to the previous year.

This trend is apparent in recent insolvency data from the Australian Securities and Investments Commission. For the 2022-23 financial year, 7,942 companies entered administration or had a controller appointed, surpassing figures from previous years, including 4,912 in 2021–22 and 4,235 in 2020–21.

Most of these companies were SMEs.

“Unfortunately, given the decline in the average value of trade invoices and the record level of trade payment defaults recorded in February [this year], we expect that the rate of external administrations will continue to increase over 2024,” says CreditorWatch.

Indicating an economic slowdown

CreditorWatch Chief Economist Anneke Thompson notes that a persistent trend in the BRI data indicates a rapidly slowing economy. This pattern is now reflected in the December 2023 quarter Australian National Accounts, which provide comprehensive data on the country’s economic performance.

“Gross domestic product grew by a very slow 0.2% over the December quarter, taking the annual growth rate to 1.5%,” says Thompson. “However, in per capita terms, GDP has been negative for three straight quarters, which means Australia is in a ‘per capita’ recession.

“The sustained fall in the average value of invoices over 2023 was a very good leading indicator of the overall slowing of the economy.”

For SMEs struggling with cash flow, it is important to take proactive steps to safeguard their businesses. Engaging with their brokers or financial advisors to assess their financial situation and explore strategies can help mitigate risks.