The number of ‘zombie’ small and medium-sized enterprises (SMEs) in Australia is growing as more businesses are kept alive by government support.

While the number of business administrations is down, that doesn’t tell the full story, according to digital credit agency CreditorWatch. A blowout in payment times between businesses indicates that thousands of Australian enterprises are now relying on government support to stay afloat, it says.

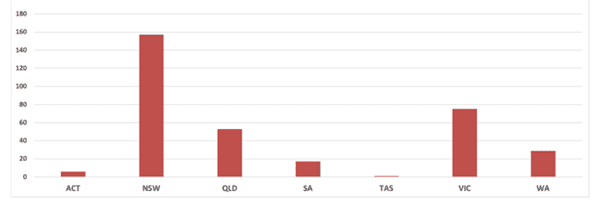

CreditorWatch data shows that the number of business administrations fell 37.1% from July to August and is 59% lower than the 2019 average. Victoria recorded the largest drop at 49.3%, followed by New South Wales at 34.3%.

Figure 1: External business administrations in August 2020

However, many SMEs are now struggling with their cash flow, judging by a blowout in their payment times, the agency says. An important cash flow indicator, payment time between businesses increased to an average of 43 days from July to August.

This means businesses are waiting almost three times longer to be paid than the average period in 2019.

Companies from the transport, postal and warehousing, and administrative industries are particularly struggling to pay their bills on time, followed by those providing administrative and support services. On average, these businesses were 90 days behind on payments in August.

“With payment times staying stubbornly high, it’s clear that the SME sector is struggling to generate cash flow outside of government support, indicating that there is a mountain of trouble behind the curtain of stability,” says CreditorWatch Chief Economist Harley Dale.

Increasing insolvencies

After the federal government extended the safe harbour measures designed to prevent business insolvencies, CreditorWatch warned that there would be a “tsunami of insolvencies” in January 2021.

The government introduced legislation in March 2020 increasing the threshold at which creditors can initiate bankruptcy proceedings, and protecting company directors from personal liability for insolvent trading. It was just one of more than 80 regulatory changes intended to give businesses and individuals temporary relief during the COVID-19 crisis. The safe harbour measures were supposed to end on 25 September but have been extended to 31 December 2020.

“Whilst [the] safe harbour legislation was critical in stabilising the Australian economy as it went into recession, the measures are now becoming counterproductive because they are propping up companies that should be allowed to fail,” says CreditorWatch CEO Patrick Coghlan.

“It means that solvent businesses are having to trade with otherwise insolvent debtors, risking their own health, while doomed businesses are able to put off paying creditors or even the Australian Taxation Office,” he adds.

But others believe the extension is an important aid for businesses.

“With Australia’s economy having plunged into its first recession in nearly 30 years, there is no doubt that these changes will help avoid a potentially unprecedented wave of financial distress and corporate collapses,” says Michael Hughes, Partner at law firm MinterEllison.

Chartered Accounts Australia and New Zealand Business Reform Leader Karen McWilliams urged businesses to approach the safe harbour extension with prudence.

“For some businesses, the government’s support will mean they can survive and recover, but for many others, this extension will do more harm than good in the long term,” she says.