Chinese investors remain prominent in the Australian property sector, maintaining their position as the largest foreign buyers of real estate. After spending $3.4 billion on approved residential property purchases in 2022–23, they are continuing to actively invest in the market.

The latest data from the Foreign Investment Review Board (FIRB) shows that home buyers from China spent $700 million in the July–September 2023 quarter, making 523 purchases during the period.

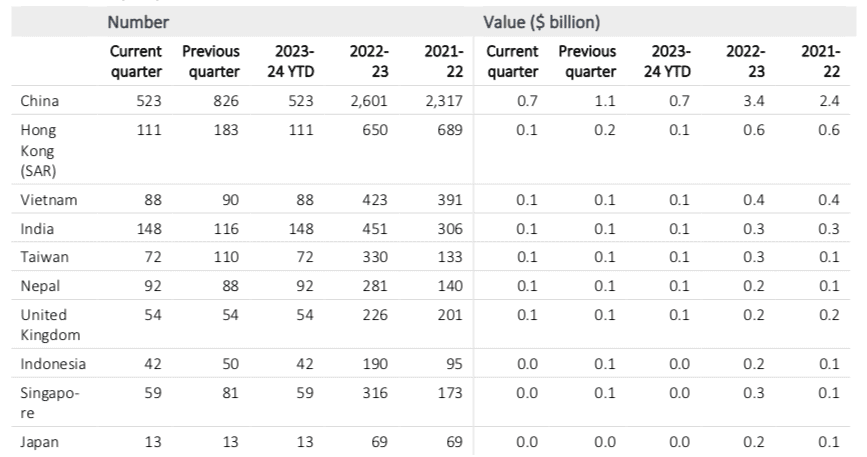

While these figures represent a decrease from the previous quarter’s $1.1 billion and 826 transactions, Chinese investors still maintained a considerable lead over other international buyers. As Figure 1 shows, investors from Hong Kong, Vietnam, India, Taiwan, Nepal and the United Kingdom (UK) each spent a total of $100 million on Australian residential properties during the quarter.

Indonesian, Singaporean and Japanese buyers rounded out the top 10 buyers, with each group purchasing less than $100 million worth of homes.

Figure 1: Top 10 approved residential real estate investment sources, July–September 2023

Source: Foreign Investment Review Board, Quarterly Report on Foreign Investment 1 July – 30 September 2023

Renewed appetite for offshore property

The renewed interest in overseas real estate that cashed-up Chinese buyers are showing comes after nearly three years of stringent COVID-19 policies, which led to a drop of up to 60% in their international property investments.

This resurgence is attributed to a combination of factors, including the ongoing property crisis in China and the appeal of stable markets like Australia. With the Chinese property market experiencing a downturn, real estate in such overseas destinations stands out as a safer option.

“Overseas, Chinese investors are drawn to real estate investment as an easily understood category that’s expected to provide price appreciation and dependable long-term foreign currency income, uncorrelated with the Chinese economic cycle,” said Kashif Ansari, Co-founder and Group CEO of real estate firm Juwai IQI.

“In this era of higher interest rates, Chinese investors with access to ready capital have an advantage over local buyers.”

Top destination

Data from Juwai IQI shows that Australia was the top overseas destination for Chinese property seekers in the first half of 2023, followed by Canada and the UK. This trend is expected to continue, as around 70,000 people are predicted to move from China to Australia between 2023 and 2025.

However, Juwai IQI sees a decline in the number of Chinese and Hong Kong investors purchasing properties as non-residents.

“Most are waiting until they have permanent residency in Australia,” said Daniel Ho, the company’s Co-founder and Group Managing Director. “If you know you’re on the path to getting permanent residency, there’s no reason to pay the extra costs that come with purchasing as a non-resident.”

Buying property as a non-resident typically means paying higher transfer or stamp duties, with some states imposing a surcharge ranging from 7–8%. Owning property as such also results in additional costs due to land tax and vacancy tax.

For example, when buying an existing home valued at $1.1 million, a foreigner would need to fork out $84,600 in application fees and be subject to an annual vacancy charge of $169,200.

Rapid growth ahead

Looking ahead, Ho expects Australian real estate purchases by Chinese buyers to grow more quickly than those by other Asian investors, as China continues to recover from the pandemic’s impact.“Overall, purchasing will be driven by relatively strong economies and Australia’s attractiveness for investment and lifestyle,” he added.