Australia’s home loan market is experiencing a flurry of activity as lenders reduce fixed rates. Is now a good time to secure these lower rates?

Despite the Reserve Bank of Australia (RBA) holding the cash rate steady at 4.35% in September 2024, a growing number of lenders have trimmed their fixed rates for owner-occupiers paying principal and interest. In the last week of September alone, 11 lenders reduced these rates, with Aussie lowering them by up to 65 basis points for terms ranging from two to five years.

This shift reflects a broader market movement. Data from the financial comparison site Mozo shows there were more than 200 fixed rate cuts in September, offering borrowers competitive options starting at 5% per annum.

“For those in the market for a home loan, now could be a great time to lock in a fixed rate,” says Mozo finance expert Rachel Wastell.

Rate cuts by major banks

Australia’s big four banks have also been adjusting their rates, with NAB the latest major player to announce reductions. The bank recently cut its fixed rates by up to 0.5 percentage points for principal and interest loans and 0.65 percentage points for interest-only loans.

According to a RateCity.com.au analysis, NAB’s move brings its three-year fixed rate in line with Commonwealth Bank of Australia and Westpac, with only ANZ still offering a mortgage product above 6% for the same term.

Macquarie Bank has also lowered its fixed rates by up to 0.40 percentage points. Its lowest rate now sits at 5.39% for a three-year fixed term. However, this still trails behind the market’s most competitive option – SWS Bank’s three-year fixed rate of just 4.99%.

Borrowers hesitant to choose fixed-rate loans

Despite fixed rates dropping, many borrowers still prefer variable home loans as they anticipate cuts to the cash rate. Recent Australian Bureau of Statistics data shows that only 2.0% of new and refinanced loans in August were fixed rate.

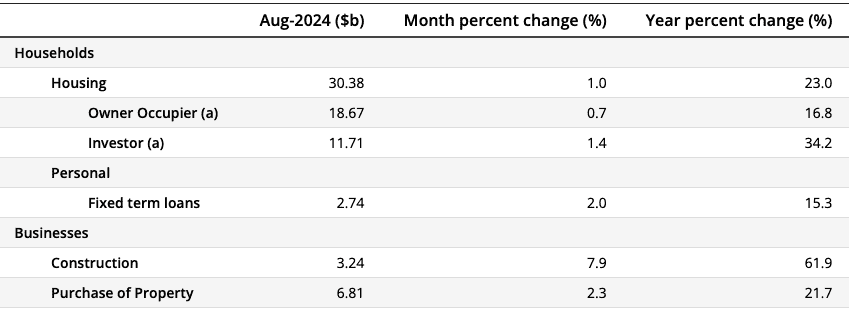

Value of new loan commitments (seasonally adjusted), August 2024

Source: Australian Bureau of Statistics Lending Indicators, August 2024

“The appetite for fixing is nowhere near warm,” says Sally Tindall, Data Insights Director at Canstar.

Similarly, RateCity.com.au Money Editor Laine Gordon notes, “Right now, there’s not a huge gap between the lowest fixed and lowest variable rates, but a few cash rate cuts could paint a different picture.”

Economic forecasts suggest the RBA may cut the cash rate as early as December 2024. This could drive variable home loans lower and make them more appealing in the short term.

For borrowers uncertain about future rates, Wastell suggests that a split loan – part fixed and part variable – might be an attractive option. “This way, you can hedge your bets and potentially benefit from future RBA cuts without missing out on the comparably low fixed rates available now,” she adds.

What to expect

Competition in the fixed-rate loan market will likely intensify as more lenders position themselves for potential rate cuts.

For mortgage brokers, helping clients navigate the current market means carefully weighing the pros and cons of fixed versus variable rates while considering each borrower’s financial goals and risk tolerance.