While the economy is probably heading back into recession, the housing market is showing no signs of reversing its growth, despite lockdowns. This is driving up home equity and raising entrepreneurs’ borrowing capacity to finance their businesses.

“Prices have accelerated far more quickly through COVID-19 than they otherwise would have, driven by a combination of exceptionally high savings rates partly as a result of huge government stimulus and record-low finance,” says Nerida Conisbee, chief economist at real estate group Ray White.

According to CoreLogic’s latest data, national dwelling values rose 5.2% in the three months to August, and 1.5% last month. Though this is the lowest monthly increase since January this year, it remains very much above average.

Sydney houses have now hit a median value of almost $1.3 million, up by $308,000 from a year ago. In Melbourne, they have reached about $954,000, an increase of more than $160,000.

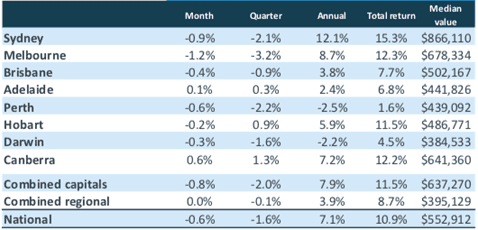

Figure 1: Changes in Australian dwelling values, August 2021

Source: CoreLogic Hedonic Home Value Index, August 2021

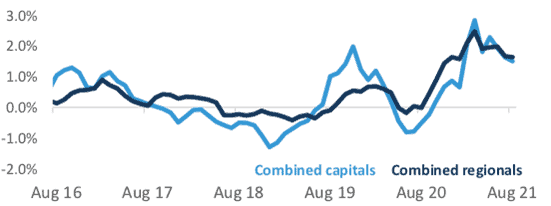

Figure 2: Month-on-month change in Australian dwelling values, August 2021

Source: CoreLogic Hedonic Home Value Index, August 2021

“The annual growth rate at the moment is trending higher. In fact, it is 3.6 times higher than the 30-year average rate of annual growth,” says CoreLogic research director Tim Lawless.

Sales activities continue

Lockdowns have not stopped transaction activity either. In fact, CoreLogic estimates that housing turnover hit its highest level in almost 12 years in August, with nearly 598,000 houses and units sold across Australia from a year ago. Turnover refers to annual home sales as a percentage of the total number of dwellings.

“Such a significant surge in housing demand may seem surprising at a time when overseas migration has stalled,” says Lawless. “However, the substantial rise in home sales can be explained by a lift in domestic demand from previously low levels.”

“The fact is, lockdowns or not, some people still need to buy,” says Nicola Powell, senior research analyst at real estate portal Domain. “They could be in between houses, they could have missed out earlier in the year, and now they’re ploughing ahead and making a strong offer.”

No market crash in the near term

Unlike last year when observers painted drab scenarios as COVID-19 sent prices falling, this time there seems to be a consensus that dwelling values will still rise in the coming months, though at a slower pace. That’s largely because demand is continuing to outpace supply.

“While sellers are holding out, we have not seen a similar hit on buyer demand,” says Conisbee.

However, the growing problem of affordability could dampen market activity.

“Housing prices have risen almost 11 times faster than wages growth over the past year, creating a more significant barrier to entry for those who don’t yet own a home,” says Lawless.

Potential credit tightening further down the road might also soften demand, while an increase in advertised supply due to a lack of more buyers could weigh on price growth, according to CoreLogic.

But over the long term, real estate analyst and property buyer Pete Wargent expects the housing market to grow strongly.

“Real estate tends to be cyclical, so the cycles will likely continue,” he says.

“Australia is a clean, safe and desirable country, with an open economy, a free-floating currency and control of its own monetary policy, so I expect population growth to return and the sector to thrive, if not boom.”