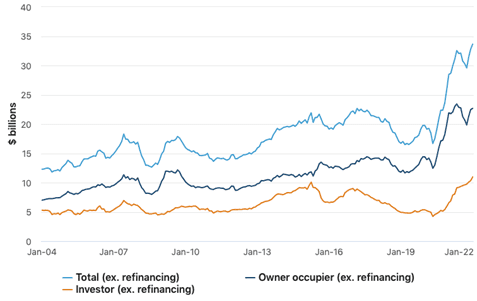

After a few years of being largely on the sidelines, housing investors are very much back. They’re borrowing more money than ever, driving a rise in lending even as mortgage rates are poised to rise.

According to latest data from the Australian Bureau of Statistics (ABS), new investor loan commitments for housing rose 6.1% in January 2022 compared to the previous month – and a staggering 67.8% year on year. In contrast, lending to owner-occupiers climbed 1% in January compared to the previous month.

“The value of new loan commitments for investor housing has grown for 15 consecutive months, consistent with the strong housing market and growth in house prices,” says ABS Head of Finance and Wealth Katherine Keenan.

Borrowers in the Australian Capital Territory (up 22.8% over the previous month), Victoria (up 11.1%) and New South Wales (up 9.8%) drove the rise in investor loans.

Figure 1: New housing loan commitments as of January 2022

Source: Australian Bureau of Statistics, Lending indicators, January 2022

Owner-occupier lending still larger

Revival in investor lending comes after a period of subdued activity caused by a regulatory crackdown on high-risk lending.

In 2017, the Australian Prudential Regulation Authority introduced a 30% cap on lenders’ share of new interest-only home loans to try to cool down the overheating property market. It eventually scrapped this limit, following its move to drop an earlier restriction capping lenders’ investor loan growth at 10%.

But even with the rising investor loan commitments, new lending to this cohort represented only a third – or $11 billion – of the total in January 2022. New housing loans for owner-occupiers accounted for $22.7 billion.

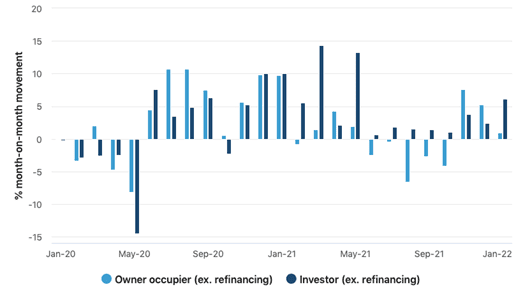

Figure 2: New housing loan commitments by purpose

Source: Australian Bureau of Statistics, Lending indicators, January 2022

“This reflects the rapid growth of owner-occupier commitments over the past 18 months,” says Keenan.

However, data suggests that this trend might be starting to slow.

The number of new loan commitments to owner-occupier first home buyers dropped 6.9% in January 2022 compared to the previous month. It fell across all markets except the Australian Capital Territory, where the figure rose more than 25% during the month.

Brokers settling more loans

The comeback in investor activity promises another area of opportunity for mortgage brokers after a period of robust growth for the channel.

According to the Mortgage & Finance Association of Australia (MFAA), brokers settled $95.7 billion worth of home loans in the December 2021 quarter – the highest quarterly figure ever reported.

This represents a nearly 50% jump from a year ago, when mortgage brokers settled a record $64.1 billion in home financing.

Writing two of every three home loans, mortgage brokers facilitated 66.5% of all new housing credit during the quarter. This was the highest ever recorded for a December quarter and was up 7.1 percentage points compared to a year ago.

A vote of trust

For MFAA Chief Executive Officer Mike Felton, the results reflect a continued vote of consumer confidence in the service mortgage brokers provide – and the choice they bring to the home loan market.

“To have our industry grow almost 50% year on year in terms of the volume of loans settled is a phenomenal result, and sends a powerful message as to the state of our industry following the significant changes made,” says Felton.

“The combination of reforms implemented – alongside brokers’ dedication to their customers – continues to produce strong consumer outcomes, driving trust and confidence and reinforcing that mortgage broking is a force for good that supports competition and choice that is critical to the Australian economy.”