With the housing market boom likely to continue, many questions are now being asked: is the market overheating? And if so, when will regulators start clamping down on home lending?

Australia’s dwelling values are back to record highs, rising at their fastest rate in nearly 18 years in February at 2.1%. And this is not likely a short-lived trend. Commonwealth Bank has forecast prices to rise 8% this year and a further 6% in 2022. In particular, it expects house prices to increase by a staggering 16% over the next two years.

While this is good news for homeowners and the housing sector in general, ANZ Chief Executive Officer Shayne Elliott has warned that prices can’t keep rising without causing complications.

“Certainly, [the housing market] can’t keep going at sort of double-digit rates for very long because you start getting real social and political problems as a result. And nobody wants that,” said Elliott.

He pointed out that any extreme and sustained movement in the market, whether up or down, can be detrimental.

“So, it’s starting to get into that area where people are starting to raise a few eyebrows, wondering if it’s a bit unhealthy at these levels.”

No regulatory action yet

But regulators are holding off taking action for now.

According to Jonathan Kearns, Head of Financial Stability Department at the Reserve Bank of Australia (RBA), what’s happening in the housing market is not of concern right now.

“One thing that you would expect from monetary policy when you have very low interest rates is that low interest rates tend to stimulate asset prices. That’s one of the channels that monetary policy works through,” said Kearns.

“So it’s not surprising to see some turnaround in the housing market, and in many ways that highlights a renewed confidence by the household sector,” he added.

Nonetheless, the RBA has vowed to keep an eye on the quality of lending.

“For us, the critical thing that we’ll be watching is the quality of housing lending, who is borrowing, what’s their ability to repay, and trying to ensure that people continue to have buffers, and thinking about the potential for there to be uncertainty going forward,” said Kearns.

The Council of Financial Regulators (CFR) has also said that it would monitor developments in home lending.

RBA is a member of the council, along with the Australian Prudential Regulation Authority (APRA), Australian Securities and Investments Commission (ASIC) and Australian Treasury.

“The council places a high emphasis on lending standards remaining sound, particularly in an environment of rising housing prices and low interest rates,” said the CFR.

Credit growth still slow

According to Gareth Aird, Commonwealth Bank’s Head of Australian Economics, regulators are more concerned about what’s happening to the stock of housing debt than the flow of new lending.

With growth in housing credit still slow, Aird doesn’t expect regulators to step in and curb lending this year. “We’re still very early on in the pace in terms of rising prices,” he said.

“It does take a while for the stock of debt to start growing in any material sense.”

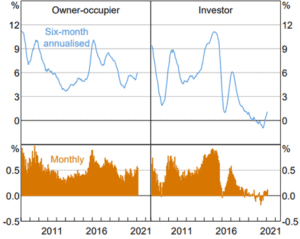

Figure 1: Australian housing credit growth

Source: Reserve Bank of Australia

Risks in the housing market

Still, regulators will likely pay more attention to the housing market in the coming months. Reserve Bank Governor Philip Lowe recently confirmed that the RBA Board has been discussing rising property prices in its recent meetings.

Lowe went on to caution against potential risks in the housing market.

“There are many moving parts at present: record low interest rates; a shift in preferences towards houses and away from apartments; strong demand for housing outside our largest cities; large government incentives for first-home buyers and home builders; and the slowest population growth in a century,” said Lowe.

“Time will tell as to how these various factors ultimately balance out, but history suggests that shifts in population growth can have large effects on the housing market.”