Equity markets saw a modest rise after projection polling in Greece showed that pro-bailout parties had successful results in the country’s latest elections, winning by a wide enough majority to control the Greek Parliament. On balance, this was a positive result, as this will begin to calm some of the fears that Greece would be forced to leave the European Monetary Union, and abandon the Euro as its official currency. Needless to say, a negative result would have brought major declines in stock prices and in high yielding currencies (such as the Australian and New Zealand Dollars), as uncertainty tends to have a major dragging effect on these asset classes.

New Democracy Party to Remain Committed to Austerity

Looking at the polling results, Interior Ministry in Greece is reporting that the New Democracy party will have enough votes to form a clear governmental majority that will have the ability to implement austerity measures and meet the requirements that have been set in place by the rest of the European Finance Ministry. This is an essential aspect of the story because without this, Greece would be unable to receive additional loan funding as a means for repaying its treasury obligations and credit defaults would become increasingly likely. Many analysts had expected an alternate result (the selection of the SYRIZA party) would have made it impossible to continue being a part of the EMU.

But while the outcome was positive, market activity has lacked significant follow through, with equity markets seeing only marginal gains and the Euro trading at the 1.26 level against the US Dollar. These weekend developments did help the Australian Dollar to post a short term rally, with the currency now trading above parity (at 1.0120) against the US Dollar but given the level of concern leading up to the election, these gains are uninspiring as many brokers had actually halted weekend trading activity on the expectation of major increases in volatility. Overall, this indicates that markets are still unconvinced that the debt problems in Greece are under control and a negative downside reaction would have been much more influential than the positive result that was actually seen.

Chinese Trade Figures Rise in May

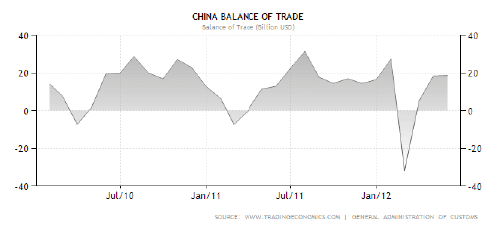

Chinese Trade figures (in both imports and exports) rose during the month of May surpassing expectations of market analysts, which forecast further declines as growth in the global market slows in momentum. On a yearly basis, the Chinese customs agency reported that exports increased 15.3 percent (by $A183.7 billion) while imports were also higher by 12.7 percent (by A$164.7 billion). The total effect of these numbers created a wider trade surplus, which has increased for three months in a row and is now seen at A$19 billion.

The data is seen as a positive for Australian commodity exporters and is coming after the Chinese central bank (the PboC) cut interest rates earlier in the month, for the first time in over three years. The validity of the numbers is questionable, however as manufacturing continues to show evidence of deterioration, with numbers showing a slowdown in momentum for seven straight months. Potential distortions in the numbers might have been created by the addition of extra work days (relative to the previous year) and higher inventory levels. Without increases in manufacturing any increases in demand will likely be viewed as unsustainable, so this will be a key area of the economy to watch in the coming months.