When will the property market bounce back?

After the 2022 plunge in housing values, homeowners might have been hoping for property prices to bounce back in 2023. But they could be in for a disappointment. Economists believe the current downturn still has some way to run.

“We’re still [near] the start,” said Westpac Senior Economist Matthew Hassan in a report. “Now there’s been super aggressive tightening from the Reserve Bank, but we’ve yet to really see the impacts [of higher interest rates] flow through to the wider economy.”

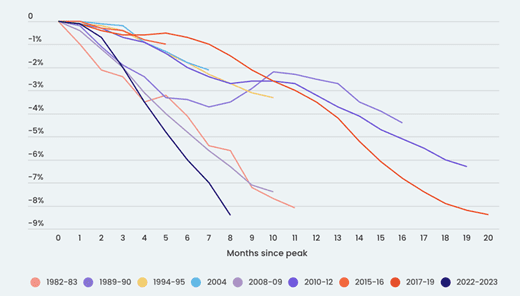

Indeed, national property prices fell 8.40% from their peak in May 2022 to January this year, breaking the previous record 8.38% peak-to-trough decline between October 2017 and June 2019.

Figure 1: Historical periods of decline in national housing values

Source: CoreLogic Daily Home Value Index

“While the housing downturn between 2017 and 2019 lasted 20 months, the new record-breaking price falls have played out in less than nine months, with further falls expected in the months ahead,” said Eliza Owen, CoreLogic Head of Residential Research Australia.

Owen believes the current higher levels of indebtedness have contributed to housing prices’ greater sensitivity to recent interest rate hikes. Latest government data shows that household debt-to-income ratio reached nearly 189% in the September 2022 quarter, compared with 183% at the start of 2017.

“Higher inflationary pressures, combined with a post-lockdown surge in spending, have also eroded household savings, which could be utilised for a home loan deposit,” added Owen.

Further declines ahead

So how much more will housing values fall?

Hassan has forecast a decline of 16% from peak to trough across the country, based on expectations that the cash rate will peak at 3.85%. Now at 3.10%, the cash rate was last raised by the Reserve Bank of Australia (RBA) in December 2022 and could be in for another hike in February.

“Overall, it looks to us like we’ve got another 12 months of price declines ahead, but they’re likely to be at a milder pace than we’ve seen through 2022,” said Hassan late last year.

He forecasts that recovery will start in 2024.

“If we take previous recessions as a guide, property downturns have tended to come in two distinct phases. In the first phase, interest rates are going up and price declines tend to be sharp. In the second phase, rates are high, but not necessarily rising, broad economic weakness starts to feed through, and the declines begin to moderate.”

With the full impact of RBA’s eight successive rate hikes yet to be felt, AMP Capital Chief Economist Shane Oliver has predicted housing prices will fall up to 20% from peak to trough.

“Australian residential property prices likely have more downside ahead of a September quarter low,” said Oliver. He expects home loan repayments to reach record highs as a result.

“This is likely to result in a sharp rise in mortgage stress, particularly as fixed rate loans reset this year,” said Oliver in a separate report.

An increase in housing demand

While expecting prices to continue to soften this year, Domain’s Nicola Powell doesn’t see the downturn erasing the growth from the pandemic boom.

“This tells us we need to view property as a long-term investment,” she said. “If we do, timing becomes less important. It’s the time spent in the market that counts.”

Powell, who is Chief of Research and Economics at Domain, also expects a resurgence in immigration to boost demand for housing.

“Australia’s economy has historically been based on strong levels of overseas migration and international students,” she said. “As part of the budget, the Australian government has increased its quota for the permanent migration program to address the skills shortage gap, essentially the biggest immigration drive ever for Australia.

“This will boomerang back as an influx of people arrive from overseas and add additional demand to our housing market.”