Australia faces the biggest risk of a downturn due to household debt reduction among major economies, according to investment bank Morgan Stanley.

“The weak housing market and potential for a further tightening of lending policies have left the country exposed to a possible wipe-out of $700 billion in household wealth”, the bank says.

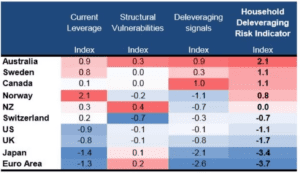

According to Morgan Stanley’s latest analysis of household debt in the Group of Ten (G10) economies, Australia looks “most exposed” to a slowdown. This is due to a combination of high household and external debt, weak domestic housing conditions, and likely prudential and tax policy adjustments.

Figure 1: G10 Household Deleveraging Risk Indicator

Driven By Property Debt

Many economists believe debt deleveraging is overdue in Australia. While households in Japan, the European Union, the UK and the US reduced their debt after the global financial crisis, those in Australia, Canada, New Zealand, Sweden and Switzerland ramped up their borrowing, says Morgan Stanley.

By 2015–16, around three in 10 Australian households were ‘over-indebted’ based on their ratio of debt to income or assets, according to the Australian Bureau of Statistics (ABS). The average household debt also nearly doubled, from $94,100 in 2003–04 to $168,600 in 2015–16, driven by property debt.

Over-indebted households were more than twice as likely as other indebted households to have a home loan, according to the ABS. And they were about four times more likely to hold other property loans.

Figure 2: Major economies with high and rising household debt-to-GDP ratios, 2009–2017

By debt-to-GDP ratio, Australia’s household debt has reached a record high of more than 120% and is surpassed only by Switzerland, data from the Bank for International Settlements (BIS) shows. The BIS has warned that high household debt can make the economy more at risk of disruptions and potentially harm growth.

Imminent Deleveraging

Australia’s falling house prices and slowing credit growth suggest that this risk of disruption through deleveraging is “imminent”, says Morgan Stanley.

The country’s national dwelling values fell 0.5% in October 2018, bringing the annual home price decline to 3.5%, according to CoreLogic. Annual falls in Sydney and Melbourne have reached 7.4% and 4.7% respectively.

Tighter credit availability has put a drag on housing demand and driven home values down. It has made it particularly difficult for home investors to access financing. The Australian Prudential Regulation Authority has introduced strict lending policies in recent years, which have hit the home investment segment the hardest. These policies include stringent mortgage serviceability requirements and limits on interest-only lending.

While Morgan Stanley acknowledges that the Australian economy is resilient, with its GDP growing more than 3% annually, the bank does not believe this level of growth will continue. It says that a housing oversupply is driving weakness in the economic outlook.

“Risks are building, given the consumer has supported consumption by tapping into their savings rate, which has fallen to 1%, while the residential construction cycle is peaking now, and will exert a drag on currently record-high construction employment,” says Morgan Stanley.

“Strength in the global economy and support from public infrastructure spend are mitigating these headwinds, but the risk of a longer/deeper-than-usual balance sheet recession remains elevated, if these conditions change,” it adds.

A $700 billion wipe-out

Morgan Stanley predicts real house price will fall by 10–15%, up from its previous projection of a 5–10% decline.

“From the perspective of wealth effects, our forecast 10–15% real house price decline would combine with 20% debt/asset gearing levels to inflict a serious dent in net worth,” it says.

This combination would equate to $700 billion of wealth write-off if mapped across the value of all property owned by Australian households, according to the bank.

Warning of risks

Morgan Stanley is just one of the growing number of organisations to have sounded the alarm about Australia’s high household debt.

In an economic forecast released in May 2018, the Organisation for Economic Co-operation and Development (OECD) identified the slowing housing market and high household indebtedness as the biggest risks to the Australian economy.

“Unexpectedly large corrections in house prices would reduce household wealth, and could cut consumption and damage the construction sector,” says the OECD.