With the world economy being viewed at something of an inflection point, and widespread disagreements over the ways various central bank policies should be altered to meet a changing economic environment, it is not surprising to see that investment analysts are divided in their outlooks for t[he Australian property market. But with a majority of analysts expecting Australia’s central bank to further reduce borrowing costs before the end of this year, we will likely see revisions to trend forecasts in commercial property values if these expectations are met. Here we will look at some of these long term views of how potentially positive scenario might play out over various time frames.

Australian Property Surveys Point to Positive 2-Year Outlook

The latest survey from the Australian Property Institute shows that real estate markets expect a modest but steady improvement in all property sectors (commercial, residential, industrial and retail properties) through 2014. The survey draws on the forecasts of fund managers, property financiers and real estate investment analysts and is widely considered to be one of the most respected indicators of market sentiment for all regions of the Australian market.

Looking at the specifics of the survey, it is clear that all property classes are seen trending upward, with the exception of commercial areas in Brisbane and retail areas in Sydney, which are seen as being closer to the bottom of their value cycles. Growth prospects for the commercial and retail sectors in Melbourne are expected to move ahead at a slightly faster rate when compared to the same areas in Sydney over the next year, while Brisbane is predicted to be the laggard amongst Australian capital cities during the same period.

Finding the Bottom of the Cycle

Some analysts, however, are focused on slightly longer term views when defining potential rebounds in Australian real estate values. BIS chief economist Frank Gelber extends this timeline in a recent market letter and is looking at a 5-year timeline when he predicts his recovery forecasts, saying that property trusts are making a mistake when implementing the sell-down strategies in commercial assets that have become increasingly common in the last few years.

Instead of selling property assets and using the extra cash to buy shares in equity markets, Gelber makes the suggestion that property trusts should hold these assets and re-position for what he expects to be a “strongly rising” commercial property market into 2017. According to Gelber, “It makes a lot of sense for investors to come back into property. This is not a market in anything like equilibrium. It’s bumping around the bottom of the cycle, struggling to recover,” writes Gelber.

These strategies are based mostly on the argument that a mislead majority of property market investments in recent years have created historically low real estate values and this is seen creating renewed opportunities for long term gains (over a 3-5 year time horizon).

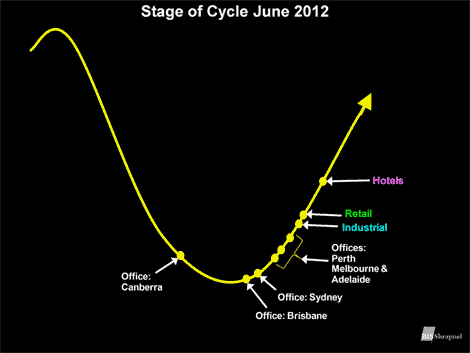

Gelber offers the above chart as a way of visualizing projected trends that will likely benefit both direct and indirect investments in Australia’s commercial property market over the long term. Office markets in Brisbane office have most recently found their bottoming values, placing the city just behind Sydney, Perth and Melbourne, which have already started a strong uptrend in values. Based on these models, industrial properties and hotels are seen at a later point in their positive trends, making them slightly less attractive in terms of potential investment gains over the 5-year period.

With vacancy rates at historically low levels (and continuing to fall), investors with exposure to these key areas stand to see stable long term gains once market sentiment begins to post a stable recovery, according to Gelber’s model. At the moment, retail and institutional investors are still showing concern and are reluctant to commit to new positions, sitting on the sidelines without fully investing in property trusts (listed and unlisted). This is reflective of a wider trend in the property markets as a whole but, according to Gelber, these investors will gradually have more income to actively put to use and allocate toward investments in commercial properties, as long as the global economy continues to improve.