Many small business owners use their homes as collateral when applying for a small business loan. However, concerns are being raised that this is no longer a viable strategy for many Australians.

The problem is a combination of tighter lending standards and housing affordability challenges in many capital cities.

Home loan lending standards have already tightened and there are warnings they may do so further as banks respond to the ongoing Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

UBS analyst Jonathan Mott is predicting major banks will impose tighter lending standards. This could “potentially lead to a sharp reduction in credit availability” Mott said in The Australian Financial Review.

As a result, even more small business owners may find themselves unable to offer their homes as security for loans.

Young entrepreneurs most vulnerable

The number of Australians aged between 25 and 34 who own a home fell by nearly one-third in the last 25 years, according to the Australian Productivity Commission’s draft report Competition in the Australian Financial System, released in January 2018.

That’s a problem for small- to medium-sized enterprises (SMEs), according to the Australian Small Business and Family Enterprise Ombudsman, Kate Carnell. “The need for equity in property, coupled with a decline in the levels of home ownership, particularly in younger age groups, is resulting in the funding gap widening further,” she said.

In April this year, Carnell launched the Affordable Capital for SME Growth inquiry to address the problems that SMEs face in finding capital. One of her key concerns was that banks consider these businesses as high risk. She said they offer “lending with restrictive terms and conditions at a price few can afford, unless the SME owner has significant equity on property to secure against the loan”.

Westpac Business Bank chief executive, David Lindberg, told The Australian Financial Review that it is difficult for young people who don’t own a home to start a business if the business doesn’t have cash flow. “If you haven’t been able to buy a house, you won’t be able to start a business,” he said. He added that banks needed to think differently about funding, and Westpac was exploring new forms of security.

Small business lending is in long-term decline

Australia’s expensive housing market has created another credit problem for small businesses – it’s become more profitable for banks to issue residential housing loans and personal loans than to provide SME loans, according to the Australian Productivity Commission.

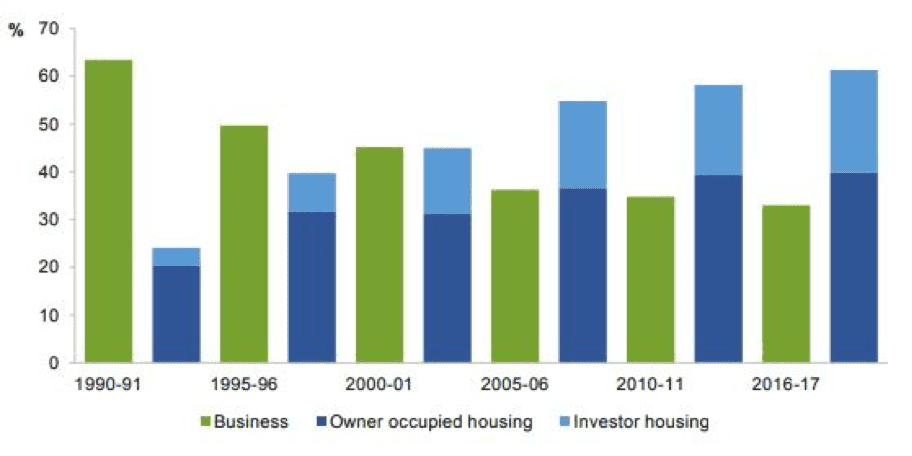

That may have contributed to a long-term decline in lending to businesses in Australia, relative to lending for residential property, according to the Australian Productivity Commission’s draft report. In fact, business lending declined to a third of total lending between 1990–91 and 2016–17. Over the same period, lending to housing investors increased from 4% to 20% of total lending.

Figure 1: Type of lending, as a share of total lending

Is there a solution?

Carnell said she plans to “investigate initiatives to provide affordable capital to SMEs to start and grow their business”. She will look at Australian initiatives where the government shares the lending risk, as well as at overseas initiatives such as the US Department of the Treasury’s Small Business Lending Fund.

The Australian Productivity Commission’s draft report recommended that APRA provide a “broader schedule of risk weights” in its Prudential Standard. This would be done instead of applying a single risk weighting to all business loans to SMEs that are not secured by a residence.

The report also stated that APRA should consider proposals by Authorised Deposit-taking Institutions to use data and risk management systems to vary the standardised business lending risk assessment. Advances in artificial intelligence algorithms and data collection could help, the report stated.

No doubt it will be some time before any of these suggestions provide any benefit to small businesses.

In the meantime, the Commission noted that competition has increased in the SME lending market. This includes the arrival of non-bank lenders and fintech companies in Australia, giving small business owners more sources of credit. That will at least provide some comfort to young business owners, who face plenty of financial difficulties getting a new business off the ground.