With home prices soaring and many buyers willing to pay hefty sums, vendors are making good money these days. But how much exactly?

According to a recent CoreLogic report, vendors made a median profit of $230,500 in 2020’s December quarter – 15% more than sellers made in the previous quarter. Owner-occupiers raked in more with about $255,000 in median profits, while investors made $165,000. Sellers who made a profit had their properties for a median period of 9.2 years, and those who incurred a loss typically held them for 6.9 years.

In total, gains from housing resales jumped nearly 29% to $31.9 billion, with nine in 10 properties being sold at a profit.

All this is encouraging more vendors to put up their properties for sale, driving further activity in the market.

Rising property values drive gains

CoreLogic Head of Australian Research Eliza Owen attributes rising profits to the booming property prices, buoyed by the cash rate reduction in November.

“The results are particularly significant given the uplift in sales volumes during the December quarter,” said Owen.

“During the September quarter, restrictions were quite severe, and it inhibited a lot of real estate activity, but once that lifted, we saw this surge in sales and listings volumes, and it hasn’t impacted profitability for vendors.”

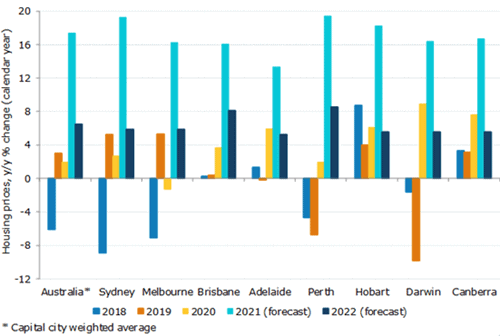

Housing prices across Australia rose 2.3% between October and December 2020 after falling 1.1% the previous quarter, heralding a strong comeback. Now, prices are expected to climb 17% across capital cities in 2021 alone, with ANZ forecasting property values in Sydney and Perth to leap 19%.

“What we’ve seen is a combination of quite strong demand and relatively low supply,” said ANZ Senior Economist Felicity Emmett. “Clearly, very low interest rates have more than offset the headwinds from higher unemployment and low population growth.”

Figure 1: Housing prices forecast for Australian capital cities, 2021

Source: ANZ Research

Hobart is the most profitable

Of all the capital cities, Hobart was the most profitable. More than 97% of residential properties sold in the city made a profit.

Melbourne came second with 94.3% of dwellings being sold for a profit as housing prices bounced back after lockdowns.

In contrast, 51% of dwellings in Darwin changed hands for a loss. Investors in Darwin particularly suffered, with 54% of rental properties selling for a loss – the highest among the capital cities.

Lower gains for unit owners

Gains from recent property sales were not even. According to CoreLogic, unit owners were more likely to sell their property at a loss. About 18.7% of units sold at a loss in the December 2020 quarter, with around 4,300 changing hands below the purchase amount.

Brisbane and the Gold Coast recorded the highest number of loss-making transactions.

Australia’s unit markets remain weak due to lower rental demand caused by a lack of international students and migrants. While house values went up 2.6% across capital cities in 2020, unit prices grew only 0.2%.

“Unit markets have historically been more popular amongst investor buyers; demand from investors has been weighed down by weak rental conditions across the unit sector along with high supply levels in some precincts,” said CoreLogic Research Director Tim Lawless.