The surge in home prices is a boon to small and medium-sized enterprises (SMEs). Coupled with low interest rates, it offers an opportunity for business owners to use their rising home equity to fund and grow their businesses.

In fact, a recent survey of small business owners by invoice financing firm Apricity Finance found that almost two-thirds of respondents have either used their home as collateral or would be willing to do so.

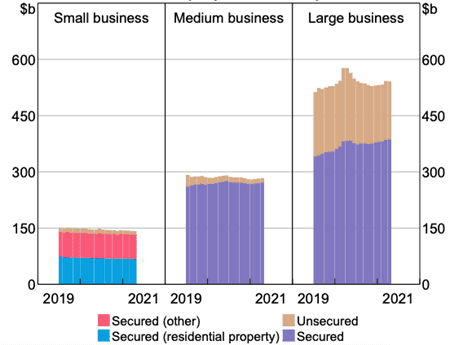

SME owners often use their home equity as collateral to get a business loan, with data from the Reserve Bank of Australia showing that around half of small business loans are secured by housing. Lenders typically see small businesses as riskier than bigger and more established companies. As a result, small firms must often deal with restrictive loan terms, including providing personal guarantees or collateral such as their homes.

Figure 1: Lending to businesses

Source: Reserve Bank of Australia July 2021 Chart Pack

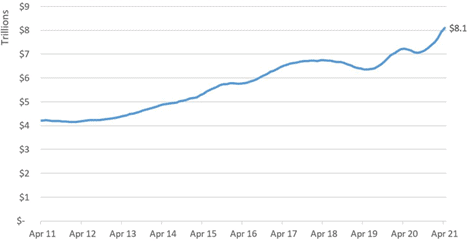

With property prices on the rise, many entrepreneurs now have higher levels of equity to help them secure business loans. Data from the Australian Bureau of Statistics shows that the housing market has surpassed $8 trillion in total value, with the mean price of dwellings rising by $39,100 to $779,000 in the March 2021 quarter from December 2020.

Figure 2: Australia’s estimated total housing value

Source: CoreLogic

“The increase in the value of residential real estate has put Australian homeowners in a strong equity position, with the RBA estimating just 1.3% of housing loans to be in a negative equity position at the start of 2021,” says CoreLogic Head of Research Eliza Owen.

This strong home equity position is enabling SME owners to take out larger amounts of residentially secured loans. For example, if an entrepreneur’s home value has increased from $2 million to $2.5 million, and they are applying for an 80% LVR loan, that frees up $100,000.

Many lenders also offer these borrowers lower interest rates than, say, those applying for unsecured loans.

Using their homes as collateral doesn’t stop SME owners from selling their property during the term of the loan. They just need to let their lender know so it can provide them with options.

Working with brokers

But business owners must be smart about taking on debt using their homes as security – they need to consider all the factors involved, including the risk. Mortgage and finance brokers can help them make the right choices.

According to Peter White, Managing Director of the Finance Brokers Association of Australia, brokers are uniquely placed to help business owners find suitable loans. “Small business owners are time-poor and need quality and reliable advice so they can access the right-fit finance they need to grow their business.”

But White adds that brokers need to better understand SMEs to serve them well.

“Many business owners are not aware of the significant increase in fintech and non-bank lenders,” he says. “But unless finance brokers understand this market – and this includes the ability to comprehend business accounting practices – our industry won’t be able to take full advantage of it.”