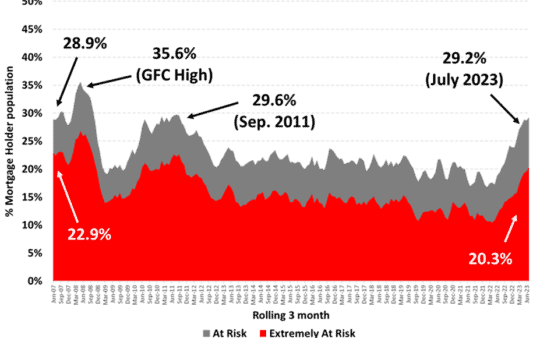

After a year of aggressive interest rate hikes, many mortgage holders are feeling the pressure. New research from Roy Morgan shows that in the three months to July 2023, 1.5 million Australians – or 29.2% of all mortgage holders – were at risk of mortgage stress.

The latest figure breaks the previous record of 1.46 million mortgage holders facing potential mortgage stress that was reached in the three months to May 2008, at the height of the global financial crisis.

A mortgage holder is considered ‘at risk’ if their repayments surpass a portion of their income – 25% to 45% depending on their financial situation.

Figure 1: Level of mortgage stress among Australian borrowers

Source: Roy Morgan’s Single Source Survey

According to Roy Morgan, the surge in July reflects a broader trend over the past year, during which the number of households at risk of mortgage stress has ballooned by 642,000. The figure takes into account the Reserve Bank of Australia’s (RBA) 12 interest rate hikes from 0.1% in May 2022 to 4.1% by June this year.

However, interest rates are just one of the variables that dictate whether a mortgage holder is at risk, says Roy Morgan CEO Michele Levine. “The variable that has the largest impact on whether a borrower falls into the ‘at risk’ category is related to household income – which is directly related to employment.”

Levine adds, “If there’s a sharp rise in unemployment, mortgage stress is set to increase towards the record high of 35.6% of mortgage holders considered at risk in May 2008.”

While Australia’s unemployment rate climbed by 0.2 percentage points to 3.7% in July, it was still lower than pre-pandemic levels. Data from the Australian Bureau of Statistics shows that the unemployment rate was 5.2% in January 2020, right before the pandemic.

In addition, Australia’s employment-to-population ratio and labour participation rate in July remained near their historical highs in May 2023, pointing to a generally positive employment outlook.

Increased mortgage vulnerability

A more concerning trend is the increase in the number of mortgage holders considered ‘extremely at risk’, or those whose interest-only repayments exceed a certain portion of their income.

Roy Morgan’s research shows that the number of borrowers falling under this category rose to just above 1 million in July 2023, an increase of 20.3% over the previous month and the highest figure in more than 15 years.

“This is an increase of over 470,000 mortgage holders from a year ago,” notes Levine.

Potential risks ahead

If the RBA lifts the official cash rate by 0.25% to 4.35% in September 2023, Roy Morgan estimates that an additional 81,000 mortgage holders would fall into the ‘at risk’ category.

Additionally, should there be another rate hike in October, 108,000 more mortgage holders would be vulnerable. This would bring the total to more than 1.6 million borrowers at risk of mortgage stress.

Levine also pointed out that while many assume the RBA’s rate hikes are done, a couple of factors could change the scenario.

“The low Australian dollar, and high petrol and energy prices adding to inflation, may force [the RBA’s] hand for further interest rate increases in the months ahead.”

For mortgage brokers with clients who might struggle to meet repayments, now is a good time to speak to them and walk them through their options. Perhaps they can negotiate a better mortgage rate, or consider whether refinancing would be a client’s best option.