The frequency of official interest rate increases has slowed in recent months. It will be interesting to see whether this trend continues and, if so, what impact it could have on the Australian housing market.

In April, the Reserve Bank of Australia (RBA) chose to hold the cash rate at 3.6%. In the previous month, CoreLogic’s national Home Value Index recorded a 0.6% month-on-month increase, the first such rise in almost a year. These, some say, are reasons for optimism.

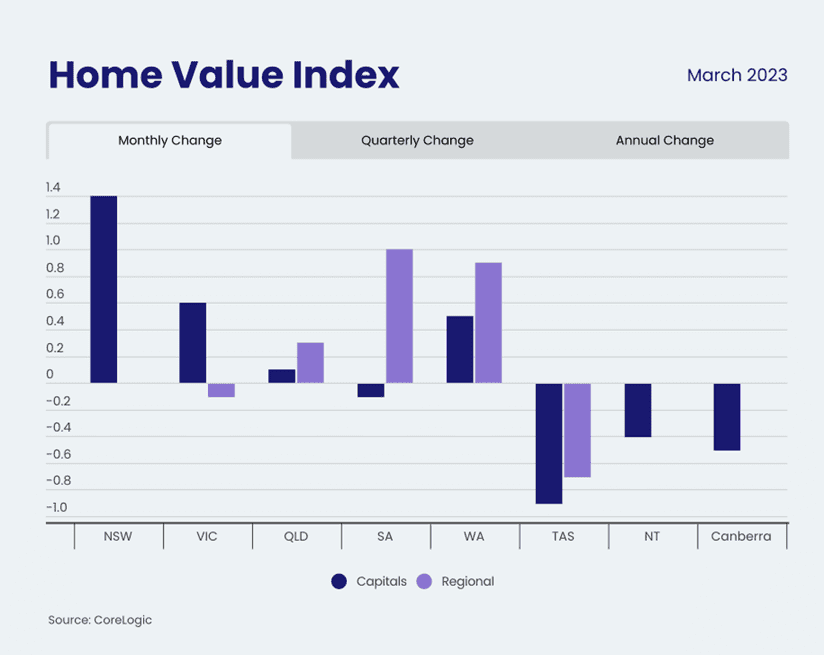

Figure 1: Australian housing market value, March 2023

Others, however, argue we are simply experiencing the calm before a storm. In fact, an International Monetary Fund report has identified that the Australian housing market has the second-highest level of risk out of all developed countries. This is based on several factors including Australia’s ratio of housing debt to household income, the share of housing debt on variable interest rates, the number of homeowners with a mortgage, cumulative interest rate changes and real property price increases over recent years.

The optimistic view

CoreLogic’s Asia-Pacific research director, Tim Lawless, has said in a recent article that while the RBA’s April decision “doesn’t necessarily mean interest rates are ‘done’, it is likely the tightening cycle is close to topping out”.

Lawless suggests an increased level of certainty about interest rates may lead to consumer sentiment improving, with a potential flow-on to the housing market.

“We know that consumer sentiment and housing market activity have a close relationship,” he says, “so any upwards movement in spirits could see more buyers and sellers returning to the market, although we would need to see sentiment lift materially before returning to average levels.”

The sceptical view

Some believe any optimism about the housing market’s immediate future is premature.

As reported in an Australian Financial Review article, Morgan Stanley’s head of Australia strategy, Chris Nicol, is sceptical about the view that a pause in interest rate increases marks a long-term easing of conditions and the beginning of the next housing cycle.

“To us, this looks somewhat premature,” Nicol says. “Our conclusion is that buying into housing and consumer-facing stocks has poor risk–reward at this juncture.”

According to Morgan Stanley, robust economic data in the coming months may prompt the RBA to continue tightening monetary policy and deliver two additional 0.25 percentage point increases in rates before the end of the year.

The most likely outcome?

NAB’s Australian housing market update for April 2023 identifies several headwinds, including:

- high interest rates – and the likelihood that “the full impact of higher interest rates is yet to flow through to borrowers”

- the expectation that the Australian economy will continue to slow over the coming months and perhaps longer

- credit being more difficult to attain than it was in previous years

- the potential for a higher advertised supply of properties, without a corresponding lift in housing demand.

However, the update also suggests these negative factors may be offset, at least partially, by a range of more positive trends, such as:

- a winding down of inflation and “a peak in the cash rate … probably around the corner”

- record highs in net overseas migration, adding pressure to demand

- unemployment levels being at generational lows, with the expectation that they will continue to “hold well below the long run average”.

Economic indicators in the remainder of this year are likely to reveal whether the housing market has, indeed, emerged from the worst of a major downturn. Alternatively, they may show there is more pain ahead. Only time will tell.