Westpac and its subsidiaries Bank of Melbourne, St.George Bank and Bank SA have announced they will no longer lend to self-managed superannuation fund (SMSF) property investors. This has occurred as the surge in SMSF borrowing – and its risks – comes under greater scrutiny.

In July, Westpac confirmed that it would no longer accept new consumer and business loan applications from SMSF property investors, effective 31 July 2018, in order to “streamline” its products. The decision has caused more jitters in a property market that is already reeling from declining real estate values and tightening credit conditions, as well as oversupply in parts of major capital cities.

Westpac and its three subsidiaries continue to service customers with existing SMSF loans. However, they no longer allow borrowers to switch from principal and interest to interest-only repayments, or to extend interest-only terms.

Surge in borrowing poses risk

SMSFs have been able to take out loans, mostly for property investments, by setting up a limited recourse borrowing arrangement. This guarantees that if a loan defaults, the lender can only seek compensation from the asset that was acquired using the loan – it has no recourse to the other assets of the fund.

SMSF property loans generally account for a small proportion of the portfolios of banks active in SMSF lending. But this hasn’t stopped industry bodies from sounding the alarm over the rise in SMSF borrowing using this arrangement.

Recent data from the Australian Taxation Office (ATO) shows that total assets under limited recourse borrowing arrangements grew nearly 18% in FY2016 to $25.4 billion – up from only $2.5 billion in FY2012. SMSFs used most of the loans to finance investments in Australian property.

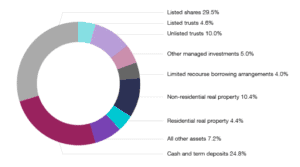

Figure 1: SMSF asset allocations in FY 2016

Advocacy body Industry Super Australia said in a recent note that the soaring interest in limited recourse borrowing arrangements has raised “serious questions” about the role this investment vehicle plays in inflating property values and exposing superannuation savings to the volatile property market.

It added that these arrangements might cause significant losses for retirement savings and put the country’s financial stability at risk if property prices in major capital cities collapsed. “The surge in assets under limited recourse borrowing arrangements and the level of asset concentration associated with holding a levered investment property in the SMSF portfolio presents challenges in terms of risk management, and it could also be exacerbating the boom-bust property cycle,” said Industry Super Australia.

Calls for a ban on SMSF borrowing

Industry Super Australia has called for the ban or restriction of the investment vehicle to protect SMSF members’ retirement savings. In 2014, the Financial System Inquiry led by veteran banker David Murray also recommended prohibiting superannuation funds including SMSFs from borrowing, arguing that property gearing would likely increase investment returns and risks. The Australian Government rejected the recommendation.

More recently, the Australian Securities and Investments Commission said in a report released in June 2018 that property gearing through SMSFs is “high risk” and may result in financial detriment to SMSF members. Its research found that some individuals moved to SMSFs to get into the property market and were using their SMSFs solely for this purpose. “They were motivated by a fear of being locked out of the property market and/or a desire to help their children enter the property market,” the report said.

The corporate regulator expressed particular concern over the operation of one-stop shops that promote borrowing for SMSF property investment, citing “conflicts of interest”. It said that it will increase its focus on property one-stop shops in the future.

National Australia Bank withdrew earlier

Although Westpac’s pullout from SMSF lending deals a blow to SMSF property investors and the property market in general, it is not the only major bank to have withdrawn from this type of lending. National Australia Bank made a similar retreat in 2015 amid concerns about the overheated property market.

ANZ is not known to offer SMSF property loans and in fact supported the 2014 Financial System Inquiry recommendation to ban SMSF leveraging. This leaves Commonwealth Bank as the only major bank that still lends for SMSF property investment.

Among non-major lenders, Macquarie Bank, Suncorp and AMP all offer property loans for SMSFs. But with Murray’s recent appointment as Chairman of AMP, the bank is expected to review its SMSF lending practices.