Australia’s 200 richest are now worth an eye-watering $667.8 billion, with their wealth averaging $3.1 billion each. The country has more billionaires now than ever, and the rich are not only getting richer but are building wealth faster, according to the latest Financial Review Rich List.

Mining continued to account for many of the country’s largest fortunes, led by Gina Rinehart, who has held the top spot for six consecutive years. Overall mining wealth rose to $141.3 billion, even as some big names lost ground this year.

Property remained a major source of net worth and contributed $125.8 billion. Around 20% of the Rich List wealth sits in property, thanks to decades of strong capital growth in real estate.

Meriton founder Harry Triguboff, one of the sector’s most prominent figures, retains second place on the list after a 12% increase in his net worth. His company brought in $1.62 billion in revenue in 2023–24, up more than 10% from the prior year.

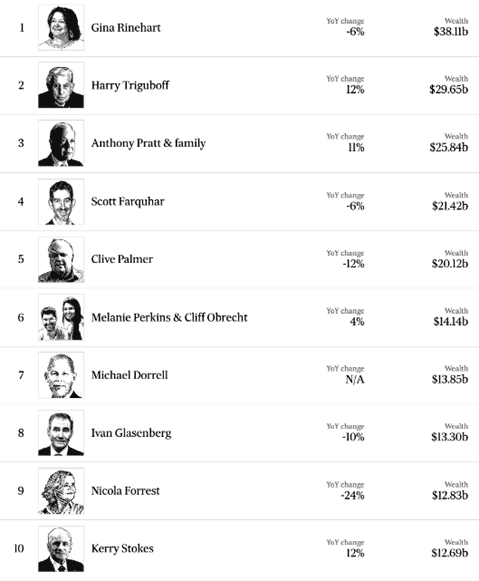

Australia’s 10 richest

Source: The Financial Review 2025 Rich List

Tech rises, retail declines

Fortunes in tech are growing fast, despite the sector being more volatile than property and mining. Total wealth reached $105.9 billion this year, almost double what it was in 2020.

Tech valuations wavered during a recent market slump triggered by US tariffs. Still, the sector added more than $50 billion to the Rich List total wealth in just five years.

Retail came in fourth, but inflation ate into companies’ profits. Even with revenue growth, rising costs meant several well-known names in the sector took valuation hits, including Solomon Lew and siblings Nicky and Simone Zimmermann.

Manufacturing remained in the top five, led by mainstays including packaging magnate Anthony Pratt. But only 8% of billionaire wealth was tied up in this sector, which had been in decline due to increased operating costs and labour shortages.

Harder to break in

While some sectors posted losses and others grew, the broader trend was upwards, with the combined wealth of Australia’s 200 richest increasing by almost 7% this year.

At the same time, fewer new names are appearing on the list – just 10 in 2025, compared with 40 in 2000. This means that it’s getting even harder to break into the ranks of the ultra-rich.

One reason could be the age of many of today’s billionaires.

Analysis by The Financial Review shows that the median age of those on the list has increased to 70, up from 55 in 1984. Those aged 80 and above now control a total of almost $159 billion.

Passing it on

Many of these Rich Listers are starting to pass wealth down to the next generation. In fact, about 40 of this year’s 161 billionaires inherited some or all of their fortune, including Rinehart’s children.

“It’s a sure bet a big chunk of this money will flow to their more than 150 children over the next decade,” say Financial Review columnist James Thomson and data journalist Joshua Peach.

“The ‘inheritocracy’ emerging among the top echelons of Australian wealth will only grow larger as the Rich List continues to age,” they add.