Still reeling from the impact of the bushfires, many Australian businesses now face the fallout from the new coronavirus outbreak (COVID-19). Australia’s heavy exposure to China inevitably makes it one of the outbreak’s worst-hit economies. Economists expect the effects to shave at least 0.5 percentage points off Australia’s GDP growth in the March quarter, setting up the economy for its first fall since 2016.

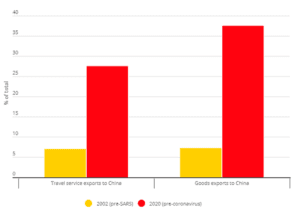

Figure 1: Australia’s exposure to China since the SARS virus epidemic

Source: ANZ using data from the Australian Bureau of Statistics

Australian small and mid-sized enterprises (SMEs) are particularly vulnerable. For example, three-quarters of surveyed members of the Australian Tourism Industry Council (ATIC) have indicated that COVID-19 has affected them or will soon affect them via cancellations or lack of spending.

This might be a good time for brokers to help their SME clients get assistance from lenders through fee waivers, deferred loan payments and other forms of support.

Hurting revenues

According to a Roy Morgan survey in mid-February, one in six Australian businesses has already felt the impact of COVID-19. Manufacturers and wholesalers are among the most affected as China’s lockdowns and shuttered factories disrupt the supply chains of Australian businesses, hurting their revenues.

Tourism businesses and educational institutions have been in the firing line since travel bans began. Australia attracts nearly 1.5 million tourists from China and generates $12.3 billion in earnings from this market every year.

“The equivalent of one month’s effective closure of this market extends beyond $1 billion in lost Chinese tourist spending, alongside associated booking cancellations and no-shows among other international visitors and even domestic travellers across regions,” said ATIC Executive Director Simon Westaway.

For businesses with operations in China, the impact is clear. Around 92% of companies the Australian Chamber of Commerce in Shanghai surveyed believe the outbreak would hit their revenue for the first quarter of 2020. About 87% expect a negative impact on their revenue for the whole year.

The first three months of 2020 would be particularly hard for these businesses. Nearly 60% expect their first-quarter revenues to drop by at least 20%.

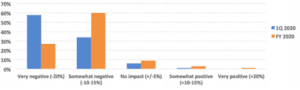

Figure 2: Outbreak’s expected impact on revenue forecasts of Australian businesses

Source: Australian Chamber of Commerce in Shanghai

Australian SMEs in the services sectors are taking the hardest blow to revenues, according to the chamber.

“There were less than a handful of businesses bucking this trend,” it said.

How long will the impact last?

As COVID-19 spreads globally, the Federal Government has acknowledged that the outbreak is hurting the broader economy.

“This is going to have a very significant impact on the Australian economy, not just on the tourism and education sectors that rely on Chinese visitors and Chinese students, but also on end-to-end supply chains,” said Treasurer Josh Frydenberg.

The Reserve Bank hasn’t updated its forecast for the economy, but its expectations of the impact on growth in early February were largely conservative.

“Overall, economic growth was expected to be weaker in the near term than had been forecast three months earlier, partly because of the effects of the bushfires and the coronavirus outbreak,” it said.

Quantifying the likely overall impact of the epidemic depends on how long it takes before the virus is contained.

“Clearly, the longer it drags on and the more the outbreak and disruption spreads globally, the bigger the impact on Australia, including the risk of two negative quarters; i.e. recession,” said AMP Capital Chief Economist Shane Oliver. “However, our base case of containment is that Chinese, global and hence Australian growth will rebound in the June quarter (avoiding recession in Australia’s case), although the risk of a delay is significant.”