Chinese buyers’ interest in Australian property weakened in 2018 but has now rebounded, giving a much-needed boost to the slowing housing market.

Robust wealth creation in China and the desire “to get a bargain while the market is soft” are driving Chinese interest in Australia’s housing market, according to the report Australia 2019 Outlook for Chinese Residential Real Estate Buying by property portal Juwai.com.

A lack of appealing alternative investments in China and recent falls in the value of the Australian dollar relative to the yuan will continue to attract Chinese money to Australia, the report says.

Chinese interest rebounds

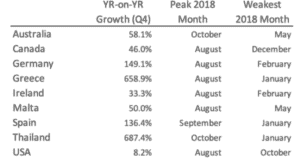

Data from Juwai.com shows that inquiries from mainland Chinese investors to buy Australian property fell 20% in 2018, but they soared by more than 58% year on year in the last quarter of the year. This signalled renewed interest in Australian real estate.

One investor paid $4.5 million for a unit in Abian Apartments in central Brisbane at the end of 2018. “That’s more than any other apartment has ever changed hands for in Abian,” says Carrie Law, chief executive of Juwai.com.

Chinese buyers remain important for the Australian market, Law says. “They help soften the blow of a slowing property market for sellers who are desperate to obtain as much value as possible for their homes.”

Figure 1: Chinese buyer inquiry trend in selected countries

Factors behind a softer 2018

Law doesn’t attribute the 2018 decline in the number of mainland Chinese inquiries to dwindling appetite for Australian property.

“There are a number of restraints holding back Chinese acquisitions of Australian property at rates much lower than actual demand.”

Instead, Law attributes the drop to the combination of tighter Chinese capital controls, Australian foreign buyer taxes and hurdles to getting financing in Australia.

Analysts in Australia consider the higher charges for foreign buyers a bigger deterrent to Chinese investors. Taxes on foreign investor purchases have gone beyond 5% in most Australian states. Both the NSW and Victorian governments have hiked the stamp duties for foreign buyers of residential property – from 4% to 8% in NSW and from 3% to 7% in Victoria.

Still, a substantial change in Chinese capital controls, and Australian taxes or financing could lead to an increase in Chinese buyer activity, according to Law.

Stable investment predicted

Law is expecting zero growth in Chinese buyers of Australian property in 2019. But she believes Australia will continue to be a major destination for Chinese property investment.

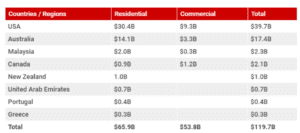

The Chinese remain the largest offshore buyers of Australian property, according to the Foreign Investment Review Board. They account for $1 of every $4 spent by foreign investors across the real estate market. In 2017, they invested US$17.4 billion in Australian property, data from Juwai.com shows.

“The Chinese are the most spendthrift of foreign buyers,” says Law.

Figure 2: Chinese property investments in 2017 by country (US$)

Melbourne to remain top choice

The Juwai.com report expects Melbourne to remain Chinese investors’ top choice for property investment in 2019 among Australian cities.

Sydney placed second to Melbourne in 2018, followed by Brisbane, Adelaide and Canberra.

“Melbourne retains clear advantages over Sydney in terms of lifestyle, prices and also a foreign buyer stamp duty that at 7% is one point lower than the NSW equivalent,” says Law.

But Sydney is not likely to be displaced from the second spot – not this year at least.

“Sydney is better known among Chinese, who consider it the iconic Australian city, with the harbour, Harbour Bridge, Opera House and Bondi Beach,” says Law. “Very few attractions in Melbourne have earned the same level of awareness among Chinese consumers.”