Australia’s housing market is headed for a boom year despite the pandemic. After dropping 2.1% earlier this year, prices are expected to surpass their pre-COVID levels, buoyed by massive government stimulus, ultra-low interest rates and pent-up demand.

While this is good news for homeowners, experts warn it will drive a wider divide between Australia’s housing haves and have-nots.

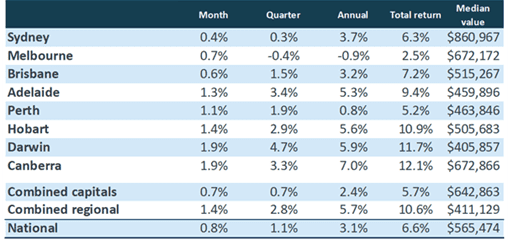

Data from CoreLogic shows that home values across the country climbed 0.8% for a second consecutive month in November. And if this trend persists, CoreLogic’s Head of Research, Tim Lawless, expects housing prices to exceed pre-COVID levels in early 2021.

“The national home value index is still seven-tenths of a per cent below the level recorded in March [2020], but if housing values continue to rise at the current pace, we could see a recovery from the COVID downturn as early as January or February next year,” said Lawless.

Figure 1: Change in housing values, November 2020

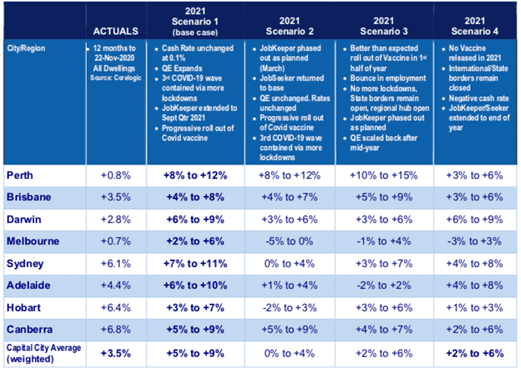

SQM Research has predicted prices in Australian capital cities will rise by up to 9% in 2021 and expects the government’s “aggressive” stimulus to be a key driver of this. Its forecast assumes the government will extend the JobKeeper Payment, which is currently scheduled to end in March 2021.

No guarantees

There are risks, however. “If JobKeeper is scaled back too prematurely, the housing market recovery in Sydney and Melbourne could stall,” said SQM. Its outlook also depends on a progressive rollout of a COVID-19 vaccine and containment of another wave of COVID-19.

The firm also warned, “Let’s keep in mind unemployment remains elevated and net migration is expected to be negative next year. We have a surplus of inner-city units in our two largest cities. And if there was another negative macro event in 2021, there is not much room left to cut lending rates further.”

Figure 2: Housing price forecast for Australian capital cities in 2021

Repercussions for the housing market

SQM Managing Director Louis Christopher also believes government policies supporting economic recovery will have long-term repercussions for the housing market.

“If housing is regarded as an asset class that is not allowed to fall, Australia could have some rather serious social issues surrounding home ownership rates over the long term,” said Christopher.

“The path they’ve put us on will mean home ownership rates are going to keep falling over the next 10, 15, 20 years. That’s bad news for liberal democracy. We don’t have a crash but instead have a massive gap between those who have a house and those that don’t,” he said.

Christopher also cautions against thinking that a property owner cannot lose in the housing market.

“[The belief] that the government will always be there to step into the housing market, if need be… that is a scary idea.”