Housing prices in the world’s most sought-after cities are slowing down after years of record growth. Data from The Economist suggests that property prices could be reaching a turning point as the average rate of house price increase across 22 cities slowed to 4.7% annually in the first quarter of 2018, down from 6.2% a year ago.

This trend could have serious implications for global economies because housing markets have become significantly synchronised, according to the International Monetary Fund (IMF).

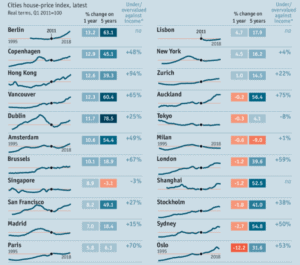

Housing prices have soared in the world’s most attractive cities in the past five years, fuelled by strong demand, limited supply and cheap mortgages. The Economist’s new house price index shows that the average price of a home in 22 of the world’s most desirable cities rose by 34% in real terms over that period. It went up by more than half in seven cities, including Auckland (56.4%) and Sydney (54.8%).

Figure 1: Global cities house price index

While some of the increases were expected as prices rebounded from the global financial crisis in 2008–09, home values across the 22 cities have since increased by an average of 56% from their lowest points. Prices in 14 cities are now above their pre-crisis high by an average of 45%, according to The Economist.

The housing markets in many of these cities are now widely considered overvalued. “Taking the average ratio over the past 20 years as ‘fair value’, national house prices in Australia, Canada and New Zealand have been more than 20% above fair value compared with income and 30% above fair value compared with rents for the past three years,” says The Economist report. “They have now hit 40% above fair value for both metrics.”

A bigger correction ahead?

This suggests that these housing markets are up for a correction. This process is already taking place in cities like Sydney, where house prices have been falling for nearly a year. CoreLogic’s data for August 2018 shows that house values in that city are down 5.6% on a year ago, the biggest decline among Australian capital cities.

Falling prices in Sydney and other cities such as Auckland and London may signal a bigger correction ahead, according to The Economist.

Research suggests that the drivers of the property boom in the world’s major cities – robust demand, limited supply and cheap mortgages – are nearing an end. The Economist expects demand for housing to dwindle as population growth in many of these cities starts to slow and some government policies discourage foreign capital.

Tightening monetary policy has also made it harder to get a mortgage. In Australia, more stringent regulations to curb high-risk lending have squeezed the supply of credit. This has made accessing housing loans difficult and triggered further declines in house prices.

Repercussions of increased synchronisation

While home price downturns are generally considered a domestic issue, they could affect markets elsewhere because of increased synchronisation among housing markets. Research by the IMF has found heightened house price synchronisation in 40 advanced and emerging economies and 44 major cities, potentially because of exposure to global financial conditions. Major cities are likely more exposed to such conditions as they are closely linked to global financial markets or are more attractive to global investors.

Figure 2: Average annual real house price growth, 2013–17

The IMF has warned that rising housing valuations increase the possibility of a simultaneous fall in house prices should financial conditions change. “Policymakers cannot ignore the possibility that shocks to house prices elsewhere may affect domestic markets,” the IMF says in its report. “Heightened synchronicity of house prices can signal a downside tail risk to real economic activity, especially in an environment with buoyant credit and high leverage.”