Australia’s housing market has long been a significant barometer of the country’s economic health. It has faced numerous challenges in recent years, including the effects of the global COVID-19 pandemic and a price downturn in 2022. However, the most recent data collected by Domain suggests the market is quickly regaining its footing.

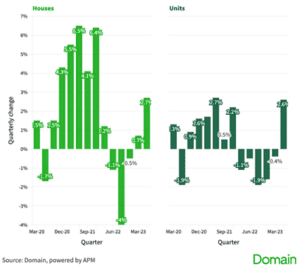

During the three months from April to June 2023, combined capital city house prices rose almost four times faster than the previous quarter, resulting in the biggest growth since late 2021. According to Domain’s latest House Price Report, this upward trend follows two consecutive quarters of growth, softening the annual decline. In contrast to the $60,000 (or 5.6%) drop in value during the 2022 downturn, house prices across the combined capitals have reclaimed $35,000 (or 3.4%) since hitting a low in December 2022.

There were house price increases across the capital cities in the June quarter. All cities have moved into a recovery phase, except for Canberra, which remains in a price trough. Sydney continues to lead the recovery, witnessing the greatest acceleration in growth (up 5.3%) – accomplishing roughly two-thirds of its recovery. Adelaide and Perth are the only capital cities where house prices are at an all-time high, suggesting they’ve sidestepped a significant downturn altogether.

Price growth isn’t confined to houses alone, according to the Domain report. After five consecutive quarters of decline, combined capital unit prices have also turned a corner. Their 2.6% (or $16,000) increase over the June quarter – the first since late 2021 – represents the most substantial quarterly gain in two years.

Figure 1: Growth in the housing values of Australian capital cities

Supply-demand imbalance fuelling the recovery

A key factor behind Australia’s housing market resurgence is the discrepancy between supply and demand. Currently, the total number of homes for sale is 22% below the five-year average for the combined capitals. Domain’s report notes this imbalance has been created by a surge in demand and an unseasonal weak flow of new listings since spring 2022.

“However, the tide is changing, as the flow of new listings improves, likely spurred by the persistent pricing recovery or homeowners selling due to the higher debt costs,” said Dr Nicola Powell, Chief of Research and Economics at Domain.

“In Sydney, Melbourne, Canberra and Darwin, new listings are higher than the five-year average – a massive shift that could help to rebalance the demand and supply equation if this trend continues.”

Promising signs, but risks remain

Obtaining a mortgage has become increasingly difficult for borrowers, with Australia’s cash rate at an 11-year high of 4.1%, and lenders issuing tight home loan serviceability requirements. This poses risks to the housing market, but the recent pause in interest rate hikes provides some short-term stability.

Domain’s report suggests that one more hike before the year’s end is likely, given inflation remains above the Reserve Bank of Australia’s target band. However, the fact that the cash rate is nearing a peak might instil positive sentiment among consumers and encourage sellers to remain active in the housing market.

Louis Christopher, Managing Director at SQM Research, shares this optimism. He told The Australian Financial Review that more buyers might venture into the market if the RBA holds off on rate increases, especially given strong migration numbers that support demand.

AMP Capital’s Chief Economist, Shane Oliver, also sees reducing inflation numbers as a positive sign that the nation is close to the top of the interest rate cycle, lessening the likelihood of a significant pullback in house prices.

“But there’s still a risk they could pull back,” Oliver told the AFR. “You could still see a slowdown in demand and in the pace of price increases, but they could be milder, depending on how weak the economy gets.”

As the Australian housing market navigates the path to recovery, keeping a close watch on evolving economic conditions and monetary policies will be crucial.