As if its impact on life and property weren’t bad enough, the bushfire crisis is also expected to cause a rise in mortgage arrears and drive down home prices in affected areas.

According to S&P Global Ratings, the bushfires could affect local employment in industries such as tourism and agriculture. This would then affect some mortgagors’ ability to meet their monthly repayments, resulting in “elevated mortgage arrears”. Property values in areas deemed less attractive or a higher risk because of fires could also depreciate.

Now might be a good time for mortgage brokers to reach out to clients in affected areas.

Rising arrears

Mortgage arrears usually go up during summer because of increased spending around Christmas time and the extended holiday season, according to S&P.

“[But] if the longevity and intensity of bushfire seasons become a more regular occurrence, arrears could remain elevated for longer periods in drought-prone areas due to the flow-on effect of bushfire devastation on local employment conditions,” says S&P.

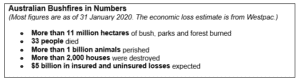

Historically, Australian bushfires have tended not to have an aggregate economic impact, according to Katrina Ell, an economist at Moody’s Analytics. But this time is different because of the scale and duration of the fires.

The impact on tourism-related employment could be particularly significant. The Australian Tourism Industry Council estimates that the cost of the bushfires to tourism will reach hundreds of millions of dollars given that the summer school holidays are the peak season for many of Australia’s tourist hotspots. Then there is the global media coverage that could scare off foreign tourists.

“Visitor numbers are significantly down in summer hotspots as smoke haze and uncertainty about safety keep local and international travellers away,” says Ell.

AMP Capital Chief Economist Shane Oliver sees a bigger impact from weaker consumer spending as Australians’ confidence declines from constant news of the fires. He estimates that the bushfires could wipe off 0.25% to 1% of Australia’s gross domestic product (GDP) growth in 2020, though he expects the rebuilding activity to provide a boost later in the year.

Effect on lenders

For banks, the impact of the bushfires on employment could heighten the risk of loss severity for loans in residential mortgage-backed security (RMBS) transactions in fire-hit areas, according to S&P. Major banks might also see a rise in bad mortgage debts as borrowers claim for financial hardship assistance.

This could add to the woes of the major banks, which have already been dealing with a slowing mortgage lending business due to higher credit standards. Housing mortgages make up a substantial share of these banks’ assets – any challenge to their mortgage business could affect their overall growth.

Figure 1: Lenders’ share of new lending commitments, November 2019

Note: ADI stands for authorised deposit-taking institution

Source: Canstar as featured in Australian Broker

However, S&P does not expect the bushfire crisis to affect the banks’ RMBS credit ratings because their exposure is higher in major capital cities than in fire-hit areas.

Impact on home values

In the short term, property buyers might avoid areas ravaged by the bushfires, according to Anna Porter, Principal at property advisory firm Suburbanite. Even houses that were spared could see their values go down if they are close to affected areas.

“The market will shy away from bushfire-prone property for six to 12 months after a major fire incident and this is even more so the case in the metro or suburban areas than the country as people have more choices to buy away from the bush in metro areas,” says Porter.

The bush views that once attracted a premium price could also become the reason why a property won’t sell, she adds.

“Holding on to the property for 12 months or more after a major fire event can help ease the pricing pain as the market is quick to forget and prices will readjust again.”