Do short-term letting platforms like Airbnb really drive up rents?

The answer probably depends on where you live. In Tasmania, the answer is likely a resounding yes. Airbnb is largely blamed for the dearth of affordable housing in the state. The sharing economy pioneer recently had to testify at a state government parliamentary inquiry into short–stay accommodation and its impact on Tasmania’s housing sector.

Airbnb hosts and individual property owners also face bigger penalties for rule breaches. In Tasmania, property owners need permits to rent more than four rooms in a house, or an entire house, shack or apartment. But apparently not everyone is obeying this requirement, prompting the state government to propose tougher fines.

Outside Tasmania, the NSW Government has moved to reduce the impact of short-term letting on rental affordability. It has imposed a 180-day annual cap on the number of days that empty dwellings in Sydney can be rented for. Councils outside Greater Sydney can enforce their own caps of not less than 180 days.

The NSW Government has also given strata corporations the power to prevent short–stay letting in their block.

Removing properties from the market

Recent research by the Australian Housing and Urban Research Institute (AHURI) suggests platforms like Airbnb have an impact on the availability of rental properties in specific inner–city areas that are popular with tourists.

The research examined Sydney’s and Melbourne’s rental markets. It identified Sydney’s eastern beachside suburbs as well as Darlinghurst and Manly among high–demand inner–city areas. In Melbourne, such areas include central Melbourne, Docklands, Southbank, Fitzroy and St Kilda.

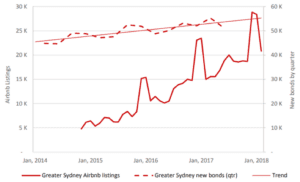

Figure 1: Airbnb listings and new rental bonds lodged for Greater Sydney

Critics of Airbnb argue that listings on the platform remove properties from the long-term rental market, driving up rents. In New York, a report by the city comptroller found that Airbnb’s popularity caused rents in the tourist areas of Manhattan and Brooklyn to go up by as much as 22% between 2009 and 2016. The dwindling supply of apartments available for long-term lease has led to soaring rents.

The AHURI research cited two market features of the high–demand inner–city areas of Sydney and Melbourne that seem to support this argument.

“Two factors – decreasing bond lodgement rates and increasing property vacancies – point to the likelihood that short-term letting is removing properties from the long-term rental market,” say the researchers. “This in turn is contributing to increasing unaffordability.”

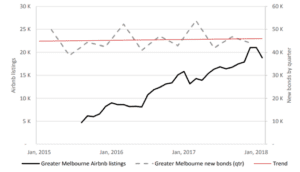

Figure 2: Airbnb listings and new rental bonds lodged for Greater Melbourne

In Melbourne, the substantial growth in housing has to some extent offset Airbnb’s impact on rental supply in high–demand inner–city areas. Still, the AHURI research found that short-term letting contributes to the challenges faced by long-term renters.

“While the city-wide affordability impact may be limited, those seeking long-term housing will face a market that is at best more complex and uncertain, and may also be moderately less affordable in some local areas,” say the researchers.

A separate study by researchers at the University of Sydney and Griffith University agreed that Airbnb has a clear impact on a small number of upscale areas in Sydney and Melbourne that are attractive to tourists.

“This represents a concern in terms of rental supply in these areas, where some local residents in the long-term rental market might be losing out to the short-term tourism market,” say the authors.

Influencing behaviour

Findings from the AHURI research also indicate that growth in short-term letting will likely reshape Australia’s housing markets by influencing how people view and deal with property.

“Short-term letting platforms provide a new form of financial opportunity for those who already have housing wealth, which adds greater flexibility to the way their housing assets can be exploited,” says the report.

These platforms also contribute to a changing view of property value, according to the report. Although many hosts may not be earning a significant amount of money from hosting through these sites, it is changing their perceptions of the value of their properties.

“Perhaps the most striking finding is the evidence that hosts are now factoring in hosting as part of their thinking about future property choices,” says the report.

“Short-term letting therefore seems likely to have a cultural impact as well as an economic one.”