Macro Update – Q2 2013

If there was one word describe Q2 2013, it would be ‘volatile’. It began with the Cypriot banking crisis which created instability in the global banking system. This was closely followed by the implementation of the US Sequester which caused more instability as its impact on US economic growth was unknown. Whilst the US recovery has continued un-impeded by the Sequester this has caused its own problems as rumours swirl around the unwinding of the US Federal Reserve’s quantitative easing program (QE3). The big news coming out of Asia for the quarter has been from Japan as concerns mount that “Abenomics” is greatly increasing government debt levels without commensurate increases in economic growth. Locally, a looming federal election and leadership speculation is the backdrop for falling currency, interest rates and commodity prices, all resulting volatile financial markets with the ASX200 commonly moving up or down by more than one percentage point in June. As Rob Whitfield Head of Institutional Banking at Westpac says the “volatility appears set to continue” as financial markets price in the new economic environment over the coming months.

Cypriot Banking Crisis

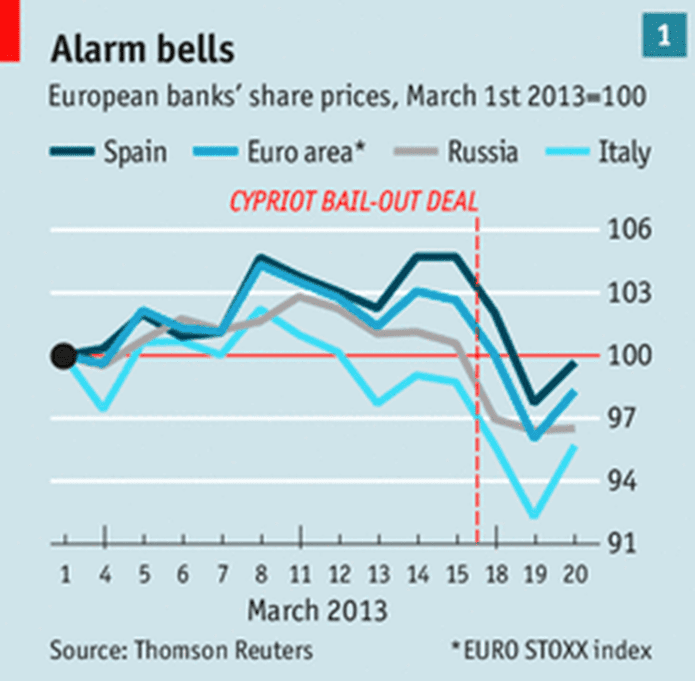

News of the crisis first broke in March. Contagion fears spooked financial markets around the world following news of the Cypriot financial crisis. The graph below shows the direction of European bank shares after news of the bailout was released. Stock markets around the world were also affected with the ASX 200 falling below 5000 for the first time in a month.

The US Sequester

The whole point of the Sequester was to force the US politicians to come up with a better way to work towards a balanced federal budget, the idea being that the impact of the Sequester would be so undesirable that politicians would be forced to make a deal. In the event a deal was not reached the cuts to discretionary spending outlined in the Sequester would bring about the reduction in public debt anyway. No deal was made and as a result the cuts began automatically on 1 March 2013. The sequester weighed on market sentiment for about half of March, then some positive US economic data was released and it rarely features in market commentary anymore.

The good economic data out of the US has continued to flow. US employment rose by more than expected in April, with the economy creating 165,000 jobs. The Conference Board’s consumer-confidence index posted another gain in May to hit a five-year high of 76.2. At the same time, the S&P Case-Shiller 20-City home-price index for March showed a 10.9% gain compared with the same period last year, the largest rise in seven years. All 20 cities in the index saw their house prices rise for the third straight month when measured against the same period last year. The positive economic data is reflected in the rise of the S&P 500 since March, shown in the graph below. Whilst it has come off its May 21 peak this is more a result of concern surrounding the withdrawal of QE3 than economic fundamentals.

Japan & Abenomics

The Bank of Japan (BOJ) has been steadily loosening monetary policy and boosting public spending since Q4 2012. However it’s only in the second quarter of 2013 that markets have realized that Abenomics is unlikely to save Japan from its debt woes and the graph below of the Nikkei reflects this. Since May the Nikkei has been in free fall, falling another 3% over night on 6 June. The expansionary measures being pursued by the BOJ and the Japanese government are going to increase debt in the short term. Without sweeping changes to Japan’s bureaucratic, agricultural, industrial and labour policies, economists say Abenomics is bound to provide only a temporary boost to growth while vastly increasing its public debt burden. Ayako Sera, a strategist at Sumitomo Mitsui Trust Bank sums it up ‘‘we’re going to have to reduce our expectations for Abenomics, the initiatives are too small. The direction is right but the comments are all long-term. It looks like things are going to move too slowly.’’

The Situation in Australia

On Wednesday 5 June 2013 the Australian Bureau of statistics released its Q1 2013 GDP figures, and they surprised on the downside. Gross domestic product rose 0.6% in the first quarter from the December quarter, when it gained by a similar amount. Annual GDP growth cooled to a below-average 2.5%, from 3.2% in the December quarter, the smallest gain since the June quarter of 2011. The Reserve Bank of Australia (RBA) left the cash rate on hold in its May meeting after cutting them in April to a record low 2.75% (shown in the graph below). The RBA remains willing to cut rates if it sees the need, as it is not constrained by Australian inflation numbers which are within the RBA’s target band of 2-3%.

An interesting point to note on the subject of inflation however is that of imported inflation, discussed in our February article Australian Inflation – Behind the Headlines.

If we separate Australia’s headline inflation number between domestic and imported inflation, it reveals that whilst imported inflation (tradeables) is actually negative, domestic inflation (non-tradeables) is well above the RBA’s target range (see below). One part of this equation can be explained by the high value of the Australian dollar.

By making imports cheaper and causing the negative value in the tradeables component of inflation, the high AUD is helping to ease inflationary pressure in Australia. The below chart demonstrates how the AUD is currently at unusually high levels against the USD.

What we have seen over the course of May-June is a rapidly falling AUD. See chart below which shows the AUD/USD exchange rate over the last quarter.

If this fall in the value of the AUD is sustained it has significant implications for inflation in the Australian economy and also RBA’s ability to reduce interest rates further should economic growth slow further.

A further slowing in economic growth could be brought about by a continued slide in the prices of the commodities that Australia sells. The graph below shows the fall in prices of Australia’s main export commodities, iron ore and coal, over the first half of 2013.

As lower price expectations are factored in to budgets by mining companies, fewer investments are made in new production capacity. Business investment slumped by 4.7% in the March quarter, led by a drop in expenditure in the mining sector, figures released by the Australian Bureau Statistics (ABS) showed. This is backed up by anecdotal evidence such as comments made by BHP’s vice president of finance for coal, Gideon Oberholzer, who said no new major projects were being considered after announcing cost cutting measures to be taken at several QLD coal mines. BHP’s plans to expand the Olympic Dam mine were also put on hold as a result of lower commodity prices.

Many think that mining investment in Australia has peaked for this cycle, and this is supported by the economic data being released. Western Australia’s economy recorded a surprisingly sharp drop in demand in the March quarter as the mining boom wanes. State final demand fell to -1.5% in trend terms, according to the ABS national accounts released on Wednesday. Minerals and petroleum exploration slumped 11.2%, the biggest quarterly drop since the 2004 March quarter. Engineering construction – which is dominated by the resources sector – slid 5.7%, the first drop since early 2010, when the economy rocketed out of the global financial crisis thanks to the China boom.

The worsening state of the Australian economy was brought to the fore of investors minds in May when the Federal Budget was released showing an expected budget deficit in the vicinity of $18 billion. This was blamed on falling government revenues as tax collections from business diminished. This combined with falling interest rates, falling AUD and falling economic growth has created a negative market sentiment and sense of instability in the economy. This sentiment has caused a dramatic slide in the value of the ASX 200, shown in the graph below. There is a view in the market that the non-mining Australian economy is struggling and the mining economy that had been propping up the Australian economy will soon need propping up itself.

Conclusion

Overall it has been a tumultuous quarter. The Cypriot banking crisis sent shockwaves through Europe that reverberated across global financial markets. The US remains on the path of a fragile recovery, and with rising house prices, employment and stock prices appearing to stabilize, conditions appear positive as 2013 rolls on. The big news out of Asia for once is not China but Japan, it remains a major risk factor for the global economy, should Abenomics fail the Japanese economy will surely be a destabilizing factor in global markets. The Australian economic environment continues to show signs of weakness, falling economic growth, falling currency value and falling interest rates are combining to create a feeling of instability amongst the business community.