Markets brace for uncertainty as interest rates bite

The June cash rate decision has dashed hopes of rate hikes coming to an end. While the increase in interest rates has affected mortgage holders across Australia, certain regions will be hit harder due to high numbers of indebted households.

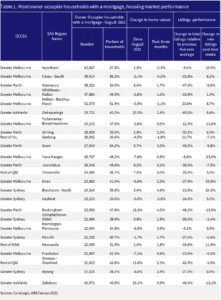

According to CoreLogic’s analysis of the 2021 Census data, areas on the outskirts of major cities have the highest concentration of mortgaged owner-occupier households. These include Melbourne’s Wyndham and Casey, and Perth’s Wanneroo.

Of the top 25 regions with the most mortgaged households, nine are in Melbourne, five in Perth and Sydney respectively, and two in Adelaide. The rest are the regional centres of Ormeau–Oxenford, Geelong, Newcastle and Townsville.

Despite the usual decline in the volume of new listings across Australia during winter, CoreLogic data shows some of these high mortgage markets have experienced an upswing in listings.

Source: CoreLogic and Australian Bureau of Statistics Census 2021

For instance, Sydney’s Blacktown (North) saw a 24% increase in new property listings to 230 in the four weeks to 18 June 2023. Although total listings in the area remain relatively low compared to previous years, the median time on the market has risen since February.

In Melbourne, the Melton–Bacchus Marsh area has also experienced an elevation in new listings, rising by 8.7% to 312 in the four weeks leading up to 18 June.

Curious rise in property listings

CoreLogic’s head of Australian residential research Eliza Owen called the rise in new listings across these areas “pretty curious”.

“Usually, this time of year it’s winter and listings should be going down, not up. Maybe there are some people who feel they need to sell their property.”

The rise in new listings could make it more difficult for recent buyers to make a capital gain if they are struggling to meet mortgage repayments. They also face increased competition from other sellers as more properties come to the market.

“As buyer demand wanes amid higher interest costs and seasonal trends, there could be an extended downturn in some of these markets as stock accumulates, such as in Melton–Bacchus Marsh,” said Owen.

“In areas such as Blacktown, where values have seen a strong bounce back in the three months to May, as supply creeps up, it may put downward pressure on the growth trend in the coming months.”

Not indicative of distress

However, the unexpected increase in listings does not necessarily suggest mortgage holders are experiencing financial distress, according to Westpac senior economist Matthew Hassan.

“It does seem to relate to the differential between prices in the market,” said Hassan in a report. “A changeover buyer is also a seller. If there’s a big stretch involved to go from the current home to the new home, that’s an affordability factor that’s not captured in other measures.”

He added that available data shows there haven’t been waves of distressed sales so far.

“Mortgage arrears to March are still relatively low. They’ve listed a little off a very low starting point, but they haven’t shown a wave of people who are selling because they’re stressed.”

Arrears rise

Data from credit ratings agency S&P Global reveals that arrears in prime loans – which are offered to borrowers with low or zero likelihood of defaulting – rose from 0.76% in the December 2022 quarter to 0.95% in the first three months of 2023. For non-conforming loans, arrears climbed to 3.7%, up from 3.2%.

As interest rates continue to rise, S&P observed that refinancing conditions are becoming increasingly difficult for many borrowers, particularly those who are highly leveraged.

“This is likely to add to arrears pressure because refinancing is a common way for borrowers to self-manage their way out of financial stress,” said the agency.

While acknowledging that challenging times are ahead for some borrowers, S&P expects strong job conditions and lenders’ proactive efforts to work with affected customers to minimise disruptions in mortgage markets.

“A recent stabilisation in property prices is also credit positive because it will help to limit the extent of losses in the event of borrower defaults,” it said.