The mining sector’s fortunes continue to keep several Australians in the upper rungs of the nation’s rich list. Nine Australians, which includes four siblings ranked collectively, who made it to Forbes’ 2019 list of Australia’s 50 richest people derived their wealth from mining, up from just seven in 2017. Together, they held a net worth of US$26.56 billion.

This collective wealth would have been larger were it not for faltering iron-ore prices and declines in the Australian dollar against the US dollar in 2018.

The estimated net worth of this year’s wealthiest Australian, mining magnate Gina Rinehart, tumbled by US$1.8 billion to US$14.8 billion due to weakening iron-ore prices, according to Forbes. Rinehart’s four children, who together placed 11th, lost US$1.9 billion of their combined fortune.

Back with a bang

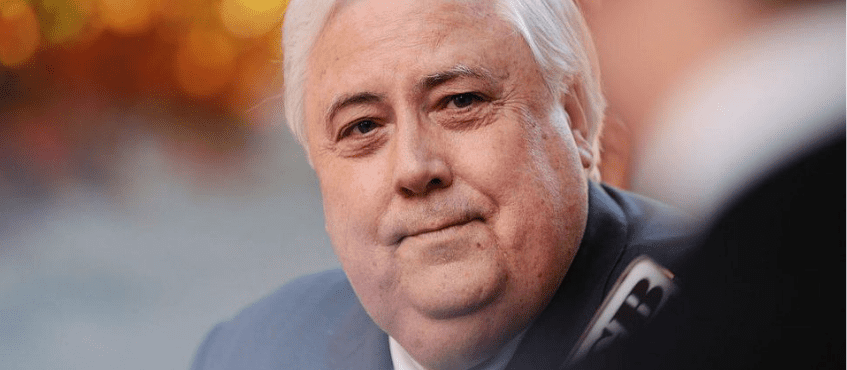

Making the biggest comeback to the list is another mining tycoon, Clive Palmer with a US$1.8 billion fortune. This places him at number 20. Forbes attributes the surge in Palmer’s fortune to the court-ordered royalty payments he received from a project of Chinese conglomerate CITIC Pacific Mining in Western Australia.

This is the first time Palmer has been listed as a billionaire in the Forbes list. Slumping commodity prices booted him out of the top 50 in 2015, when his net worth fell below the US$550 million cut-off for that year’s rich list.

Figure 1: Australia’s 20 richest individuals, 2019

| Rank | Name | Net worth (US$ billion) | Source/s of wealth |

| 1 | Gina Rinehart | 14.8 | Mining |

| 2 | Harry Triguboff | 9 | Real estate |

| 3 | Anthony Pratt | 6.8 | Manufacturing |

| 4 | Frank Lowy | 6.5 | Shopping malls |

| 5 | Mike Cannon-Brookes | 6.4 | Software |

| 5 | Scott Farquhar | 6.4 | Software |

| 7 | Andrew Forrest | 4.3 | Mining |

| 8 | John Gandel | 4 | Shopping malls |

| 9 | James Packer | 3.6 | Casinos |

| 10 | Lindsay Fox | 3.5 | Logistics, real estate |

| 11 | Bianca Rinehart and siblings | 3.1 | Mining |

| 12 | Kerry Stokes | 2.9 | Construction equipment, media |

| 13 | Michael Hintze | 2.55 | Investment |

| 14 | John, Alan and Bruce Wilson | 2.5 | Retailing |

| 15 | Lang Walker | 2.4 | Real estate |

| 16 | Fiona Geminder | 2.3 | Manufacturing |

| 17 | Richard White | 2.2 | Software |

| 18 | Maurice Alter | 2.1 | Real estate |

| 19 | David Hains | 1.9 | Investment |

| 20 | Clive Palmer | 1.8 | Mining |

Source: Forbes, ‘Australia’s 50 Richest People’

Tech entrepreneurs make biggest gains

According to Forbes, 22 of the 50 richest Australians experienced decreases in wealth in 2018, partly because of the Australian dollar’s 8.7% drop against the US dollar since the last list in November 2017.

Leading the 23 listers who have grown richer are technology honchos Mike Cannon-Brookes and Scott Farquhar, founders of enterprise software company Atlassian. Their fortunes soared by US$3 billion each, moving them up into a tie for fifth place.

Another technology baron, WiseTech Global founder Richard White, increased his net worth by US$950 million, making him Australia’s 17th richest person, up 16 places from 2017.

Property still a major source of riches

Despite Australia’s recent housing downturn, real estate continues to be a source of wealth for the largest number of rich listers. Thirteen of Australia’s 50 wealthiest acquired part if not most of their fortunes in the property sector.

Together, property moguls have an estimated combined wealth of US$27.58 billion. Leading the pack is Meriton founder and managing director Harry Triguboff, who is second on the list with a net worth of US$9 billion, down from US$9.9 billion in the 2017 list. Next is Linfox owner Lindsay Fox, who placed 10th with US$3.5 billion. Although Fox holds a large industrial real estate portfolio, he derived much of his wealth from his logistics business.

One millionaire joins club, two billionaires excluded

This year’s only newcomer to the super-rich list is financial services chief Michael Heine, co‑founder of investment platform Netwealth. Heine has an estimated fortune of US$750 million, placing him at number 50 on the list.

Missing from the Forbes rankings are billionaires Hui Wing Mau and Vivek Chaand Sehgal. Although both hold Australian citizenship, Forbes lists them under China and India respectively, where their businesses are primarily based.

Chinese-born property tycoon Hui ranked 22nd on Forbes’ China Richest 2018 with US$7.2 billion in net worth. Indian-born Sehgal, chairman of automotive manufacturer Samvardhana Motherson Group, was India’s 21st wealthiest in 2018 with US$5.5 billion.