Australia faces economic headwinds from internal and external factors, with growth expected to slow down as challenges weigh on consumer demand. For small and mid-size enterprises (SMEs), adaptability is now more crucial than ever to navigate the uncertainties ahead.

So what key trends should SMEs anticipate and proactively address this year?

Sustained inflation

Inflation is expected to persist in 2024 and beyond, affecting SMEs’ purchasing power, operational costs and ability to invest for growth.

“This means, over the next couple of years, companies will be rethinking and flexing their business models where external factors affect their pricing,” said Ryan Williams, Director of the Australian Centre for Business Growth at the University of South Australia.

“Central bank rates are unlikely to flatline or come down until the latter half of 2024, so anticipate small to moderate rate increases until then,” he added. “Anti-inflationary measures will increase financial pressure on general consumers, leading to a reduction in discretionary spending for everyday products.”

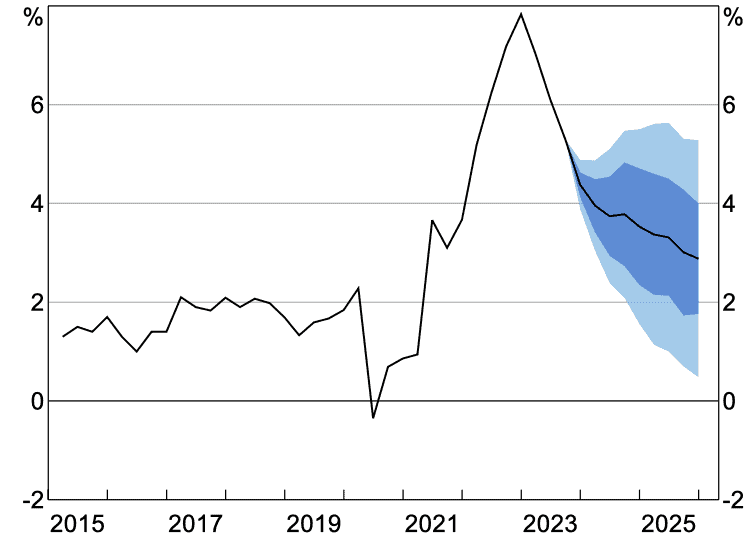

Indeed, the Reserve Bank of Australia (RBA) projects a fall in inflation to 3.5% by the end of 2024. The bank noted that the forecast decline is more gradual than initially anticipated because domestic inflationary pressures are dissipating at a slower pace than previously thought.

Recent Australian Bureau of Statistics (ABS) data shows that the consumer price index climbed 1.2% in the September 2023 quarter. While this surpassed the 0.8% increase seen in the three months to June 2023, “the rise this quarter, however, continued to be lower than those seen throughout 2022,” said ABS Head of Prices Statistics Michelle Marquardt.

Figure 1: Headline inflation forecast for Australia (year-ended)

Source: Reserve Bank of Australia using data from the Australian Bureau of Statistics

Global uncertainty

Heightened geopolitical tensions and global uncertainty compound challenges for SMEs. According to a United Nations report, this could amplify the adverse impacts on the outlook of Australia and other developed economies in Asia, given their heavy reliance on international trade.

“The major downside risks for the developed economies in Asia include diminishing external demand amid weaker-than-expected growth in China and the United States in 2024, a resurgence of inflationary pressures leading to further erosion of household purchasing power, and weaker investment growth due to tight monetary stances,” said the report.

On a favourable note for Australia, Williams pointed out that “recent engagements with China and the thawing of trade relations may represent a short-term positive for companies”.

Softer labour market

Meanwhile, the labour market is forecast to further ease in 2024 due to below-trend economic growth, potentially offering SMEs a more advantageous hiring environment.

The RBA expects this moderation to happen more gradually than initially projected, influenced by the improved outlook for aggregate labour demand.

“Much of the labour market adjustment to below-trend growth in economic activity is expected to occur through a decline in average hours worked,” said the central bank. “Over coming years, a more sustainable balance between supply and demand across the economy, including in labour and product markets, is expected to support the return to low and stable inflation as growth in domestic activity returns to trend.”

Be proactive and plan ahead

Williams advises SME leaders planning for 2024 to analyse their companies’ financial structures and identify opportunities or risks in areas such as pricing, operating costs and supply chains.

He emphasises the importance of maintaining proactive communication with lenders, not only during times of need but as an integral part of ongoing relationship management.

“2024 promises to be just as economically turbulent as 2023,” added Williams. “But by making smart decisions today, and planning ahead of time, Australia’s SMEs can navigate the choppy waters ahead and proceed with confidence.”