After collapsing earlier this year, housing market sentiment has bounced back. Australians are feeling cheery about where the property market is going as housing prices return to growth. But job security in the coming year will likely affect their confidence in the market.

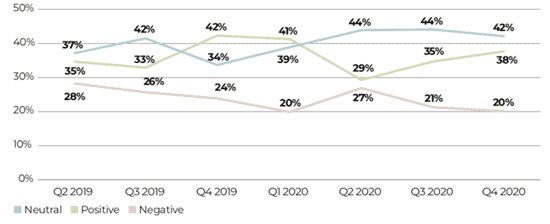

According to ME Bank’s latest Quarterly Property Sentiment Report, 38% of respondents felt ‘positive’ about Australia’s housing market – not very far from the 42% recorded a year ago. This follows a drop in positive sentiment to 29% in April 2020 as the COVID-19 pandemic battered the economy and drove property prices down.

The report shows a particularly large increase in positivity among Sydneysiders despite the fact that Sydney recorded one of the largest falls in housing prices earlier this year. About 42% of Sydney respondents felt positive about the market in October, up from only 29% in June this year.

Figure 1: Australians’ property sentiment

Rising prices buoying sentiment

National home values grew 0.4% in October after five months of decline, according to CoreLogic. All capital cities recorded an uptick in prices for the month except Melbourne, which posted a decline of 0.2%.

This has lifted homeowners’ sentiment. The ME report shows only 49% were worried about the value of their property dropping – down from 64% in April. Sentiment among property investors has also improved. About 43% in October 2020 felt positive about the market, a jump from 34% in April.

As the official cash rate hit an all-time low of 0.1%, housing market activity is likely to go back to its pre-pandemic level in the coming months.

“With the trend in housing values already rising around most areas of the country, there is a good chance lower rates could see momentum building across the nation’s most valuable asset class,” said Tim Lawless, CoreLogic’s Head of Research.

Bartolo agrees. “The cash rate cut at the start of the month may encourage some to make moves in the market – particularly first home buyers looking to take advantage of the record low interest rates, price falls and reduced investor activity,” he said.

A split

While more than half of homeowners or buyers felt more confident about buying or selling property, many (57%) of those intending to buy or sell in the next 12 months are not in a rush. They prefer to wait until the COVID-19 situation improves. In contrast, 43% said they are looking to buy or sell as soon as possible.

“Despite growing positivity and optimism for house prices, there are still many buyers and sellers who will be more comfortable continuing a ‘watch and see’ approach,” said Bartolo.