Despite the general expectation that we will see modest recoveries in housing starts, mining and infrastructure construction, the wider expectations for real estate in Queensland remain weak. Recent forecasts suggest that financing conditions will likely limit the region’s construction industry. Subdued domestic economic conditions will also weigh on demand for commercial buildings and multi-residential units well into 2013.

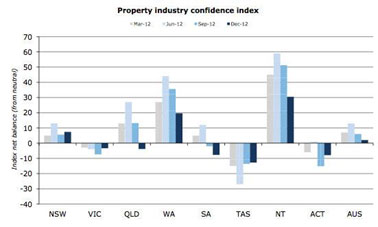

Many of these expectations are being supported by the latest ANZ-Property Council of Australia real estate confidence survey, which showed a negative result for the first time in more than a year. In essence, this suggests that the market has a weaker outlook for the property and construction sectors over a 12 month time horizon.

Here, we will look at some of the key data and factors influencing the medium term outlook in commercial properties, non-residential building, and engineering construction to get a sense of how the state will perform in the early stages of 2013.

Queensland’s Commercial Property Prospects

In Perth stronger mining conditions have filtered into other areas of the economy, creating larger needs for office space. This is however a stark contrast with what is seen in Queensland, where similar levels of commercial demand are not seen. Queensland’s substantial resource activity leads many investors to suspect otherwise, but recent data shows that this is not the case.

Market conditions in the capital city of Brisbane continue to stall as a combination of softer growth in the white-collar jobs market, government space consolidation, and the declining economic performance in non-mining industries weighs on commercial property prospects for the area.

Outlook for Building Activity in Commercial Property and Non Residential Units

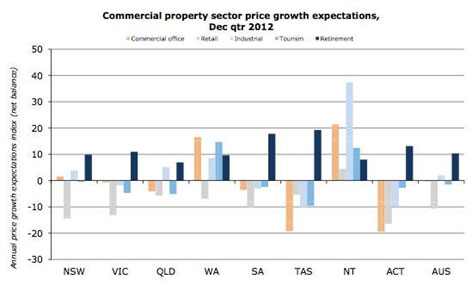

These factors lead those surveyed by the Property Council to forecast capital growth in only two of the five major commercial property sectors in 2013. According to this survey, the healthier sectors are expected to be seen in retirement living space and in industrial project areas. Beyond this, those surveyed by the NAB Quarterly Australian Commercial Property board expect the office, retail and industrial sectors to show improved vacancy rates into 2014.

Looking at the projected activity in non-residential building, the latest report from the Australian Construction Industry Forum shows an expectation of negative growth. This comes as changes in government spending, a subdued economy in the non-mining sectors, and tighter financial conditions likely to have the largest effect on retail, industrial and commercial areas. At this stage, building experts expect declining profit margins to be experienced by most of the major commercial builders amongst greater competition for lower work volumes.

Increased Opportunities in Engineering Construction

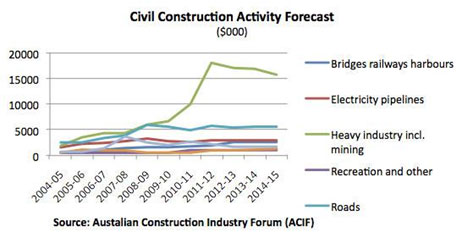

Given these factors, the largest area of opportunity in Queensland can be seen in the civil construction sector, as this area has more than doubled in the last half-decade. This has come largely as a result of the nearly 400% increase in heavy industry construction for the space. Examples of this growth can be seen in projects like Australia Pacific LNG as well as other activities directed at mining and gas exploration.

According to some analysts, this sector may have reached its peak. The wider consensus however believes the overall level of activity will remain elevated and that resource construction will continue to support prospects for the sector. Other than mining, most of the activity should be seen in non-road transportation projects (such as the Surat Basin Railway and the Cross River Rail project for 2014). Additionally, telecommunications and recreation will see benefits and the National Broadband Network and Metricon Stadium will stimulate production in these sectors in anticipation of the 2018 Commonwealth Games.

A Shifting Bias for Property Values

Australia’s most recent property surveys show that the market bias has shifted toward a general expectation that commercial real estate in Queensland will experience stalling price growth when compared to other regions in the country. These expectations take small recoveries in mining and infrastructure construction into account, so the weakness should be viewed as more systemic in nature.

As financing conditions limit the region’s construction industry, decreased levels of demand for commercial buildings and non-residential units are expected within the backdrop of a subdued domestic economy. The earliest indication of this can be seen in the latest round of confidence surveys, which reflect softer sentiment amongst property valuation analysts and commercial builders.

These surveys outline views relative to a 12-month time horizon, so potential buyers in commercial property should see lower property prices in Queensland for most of next year. As these trends show a bottoming-out in property values during this period, it would not be surprising to see investors start to watch the area for new buying opportunities as markets begin to recover later in 2013.