After a period of rapid growth, Australia’s rental market is showing signs of slowing down. Is this the start of a more stable rental environment?

According to a recent CoreLogic report, national rental rates flatlined in July and August, marking the weakest rental conditions since the early days of the COVID-19 pandemic. They rose by 39% between August 2020 and June 2024, but now appear to have hit a plateau.

The annual growth rate in rents has eased to 7.2% since it peaked at 9.7% in November 2021.

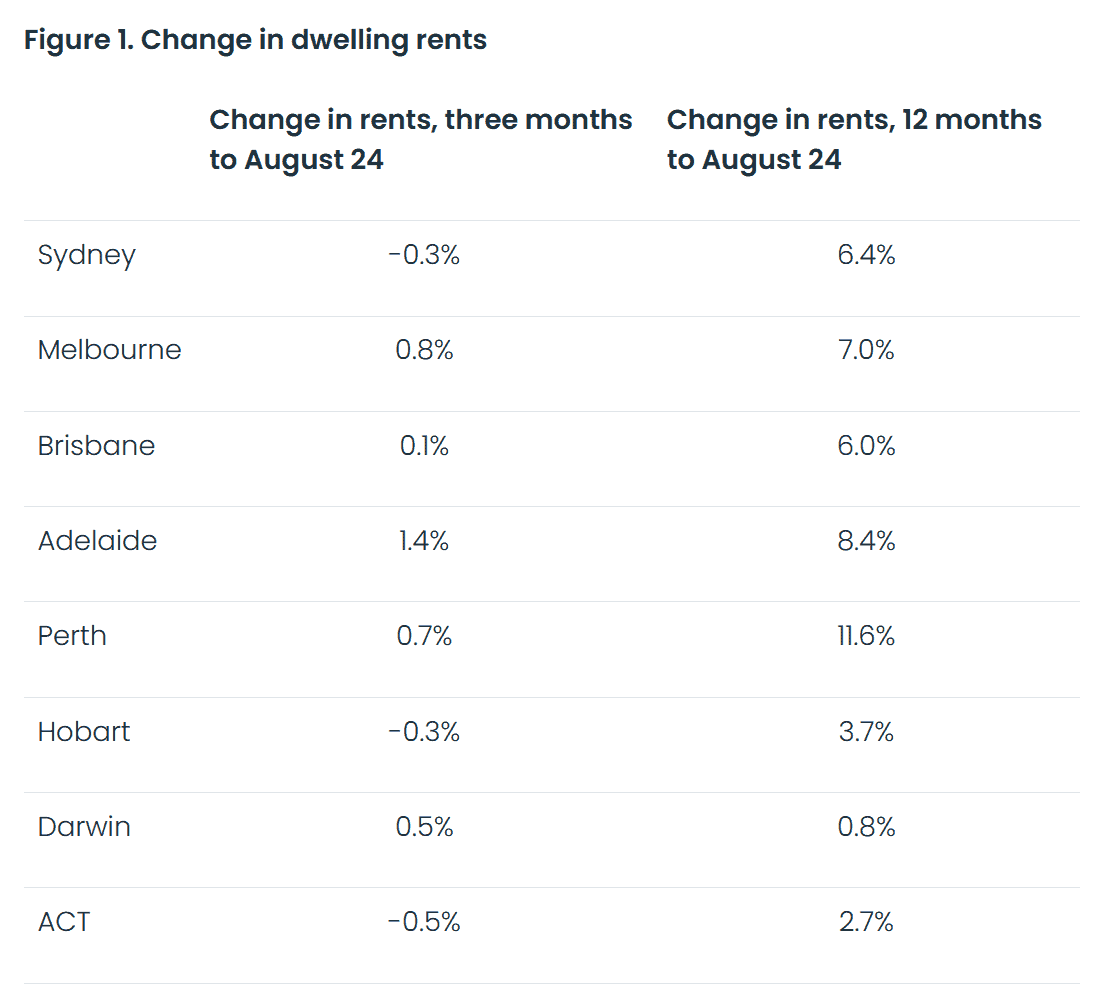

Figure 1: Change in housing rents, August 2024

Source: CoreLogic’s Property Pulse, September 2024

While seasonal trends usually see rental growth taper off towards the end of the year, CoreLogic notes that the deceleration is also being driven by underlying factors. “Rental demand is weakening as affordability constraints force a change to household formation,” explains Tim Lawless, CoreLogic’s Executive Research Director for Asia-Pacific.

Australian wages increased by nearly 13% from March 2020 to June 2024, while rents climbed by around 36%. CoreLogic’s rental affordability data shows that a median-income household now dedicates more than 32% of gross annual income to rent. This marks a record high stretching back two decades.

Affordability and household formation shifts

As rents outstrip wages, household composition patterns have changed. Household sizes shrank during the pandemic as individuals in shared living arrangements sought more privacy and space, which increased demand for housing. Now, more Australians are turning to multi-generational and shared housing options to cope with rising rents.

“While this trend [of declining household sizes] has been slow to reverse, the latest estimates show households are once again becoming larger,” says Lawless.

Eased demand from falling migration

The rapid influx of migrants, which initially increased rental demand, is also slowing. Australia’s net overseas migration peaked in the first quarter of 2023, with 165,000 new arrivals, but fell to 107,000 by the end of the year.

Rental demand may further decrease as overseas migration declines, particularly among temporary visa holders such as international students. The federal government recently announced a cap of 270,000 for new international students in 2025. This is in addition to significant changes to visa and migration policies introduced over the past year.

Regional disparities

The rental market across Australia’s capital cities presents a mixed picture.

Data from CoreLogic shows that Sydney, Hobart and Canberra all recorded slight declines in rental prices between June and August 2024. Sydney rents dropped by 0.3%, marking the first fall in nearly four years, while Hobart and Canberra saw declines of 0.3% and 0.5%, respectively.

Meanwhile, Perth and Adelaide continue to see strong rental growth, with annual increases of 11.6% and 8.4%, respectively. However, the pace of growth is slowing even in these cities. For example, rents in Perth grew by just 0.7% over the past three months, suggesting a softening market.

Wage struggles and investor activity

With rental affordability stretched so thin, some relief may come from an uptick in housing supply. The Australian Government’s HomeBuilder grant is starting to result in new homes reaching the market after delays caused by material shortages and cost overruns.

“As more new builds settle, we should see a gradual diminishment in rental demand associated with building delays,” says Lawless. “Investor activity has [also] been on the rise, with the volume of lending to investors rising 10.7% over the year to June.”

For mortgage brokers, these shifts in the rental market indicate a cooling period after years of rapid growth. Focusing on regional markets with robust growth prospects or areas with new housing developments could offer better opportunities for securing mortgage approvals and building client portfolios.