Large Australian businesses in industries such as mining and agriculture have benefited enormously from China’s growth. However, smaller Australian businesses looking to expand should also consider selling goods and services to China.

A burgeoning Chinese consumer market and improved China–Australia trade conditions offer Australian small businesses across multiple industries an opportunity to establish a foothold in China before their competitors do.

Untapped potential

Most Australian small businesses don’t sell to China, despite plenty of encouragement from the Australian Government and industry groups. In fact, only 27% of Australian small businesses sell to any overseas countries, according to a report from Australia Post.

Australia Post found that small-business exporters tend to sell to English-speaking countries, with the most popular export markets being the United States, New Zealand and the United Kingdom.

China’s consumer boom

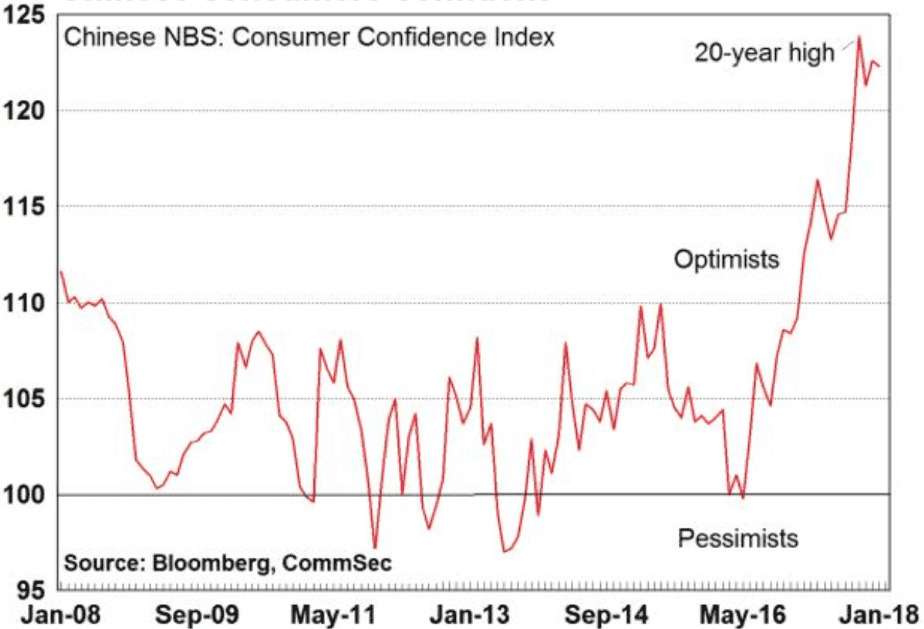

The growth in China’s consumer market holds potential for Australian small businesses entering the Chinese market. Consumer confidence in China is at close to a 20‑year high, according to CommSec.[2] It reported that China accounts for about 42% of the value of global retail e-commerce transactions.

Trade conditions with China have also improved since the 2015 China–Australia Free Trade Agreement (ChAFTA) reduced Chinese tariffs on various goods sold by Australian businesses. This helped push the value of Australian goods and services exports to China to a new record in 2016–17.

“[ChAFTA] has put Australian exporters in pole position to capitalise on China’s growing middle class and their increasing demand for the high-quality goods and services Australia offers,” said the Minister for Trade, Tourism and Investment, the Hon. Steven Ciobo, in March last year.

Figure 1: Chinese consumer confidence

Which Australian sectors could benefit?

Small businesses in the mining, agriculture, food and tourism sectors are well placed to benefit from Chinese demand, though opportunities also exist for those in other sectors.

The Australian Government has flagged potential opportunities for professional services businesses in China, including those with expertise in fields such as health, aged care and architecture.

Australian businesses with expertise in infrastructure construction could also potentially find work, because of China’s Belt and Road Initiative. This initiative aims to improve Chinese trade routes and is expected to result in infrastructure projects in the Asia-Pacific region. Last year, Minister Ciobo said he would work to identify opportunities for Australian businesses to help address infrastructure shortfalls across the region.

Australian education technology experts are well positioned to meet demand for services from China’s large education market, according to Minister Ciobo. He has said there could be a market for businesses with expertise in developing online curriculums.

Retailers could benefit from Chinese consumer spending. There are 460 million online shoppers in China, according to Australia Post, and that number will increase as China’s middle class grows.

What’s holding Australian small businesses back?

Despite these opportunities, many smaller Australian businesses have concerns about doing business in China. According to the President of the Australia China SME Association, David Thomas, many believe that “exporting to China is expensive and laden with complicated regulations and requirements”.

Australia Post reports that small-business exporters often inadequately plan their export sales strategy. It found that small businesses often fail to seek assistance when they begin selling overseas, and recommended they put more effort into research and planning, including on-the-ground research.

Despite these challenges, more Australian small businesses will no doubt invest time and money selling to China in the coming years. It will be interesting to see whether China becomes a large source of revenue for them.