When the housing market is booming, one question is almost always sure to surface: are people borrowing more than they can pay? And that question has now started to pop up more as super low interest rates drive many Australians to take out ever-larger loans to secure properties. But are economists and policymakers concerned – or should they be?

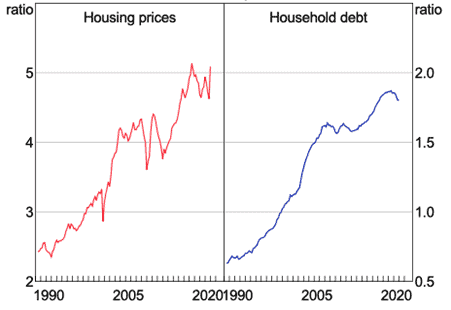

Australia has one of the highest household debts among advanced economies, and most of that debt is linked to mortgages. The household debt to income ratio stood at 180% in the September 2020 quarter. While this has narrowed since June 2019 – when it reached a peak of 187% – it has soared over the past three decades. The ratio was only 66% in September 1990.

Figure 1: Housing prices and household debt

(ratio to household disposable income)

Source: Reserve Bank of Australia Chart Pack, April 2021

Although low interest rates and increased debt have shored up the economy since the height of the COVID-19 crisis, economists are wary of long-term risks. These include the ability of households to repay loans, especially given that wage growth has fallen behind housing prices.

The latest data from the Australian Bureau of Statistics (ABS) shows that wages grew 1.4% in 2020, which is less than the 2.2% increase the previous year. National median housing prices went up 3% in 2020 and are forecast to climb 17% across capital cities in 2021.

As borrowers take on bigger housing debts, low wage growth could mean dealing with a large financial burden for longer.

Economists believe the Reserve Bank of Australia (RBA) should have focused more on wage growth to help make sure households are able to pay back their loans.

“If you don’t get wages growth, then people will be stuck with these mortgages for much longer and that’s going to have an impact,” said Gareth Aird, Commonwealth Bank’s Head of Australian Economics.

The RBA is aiming for wage growth of more than 3% by materially lowering the unemployment rate. It has missed its targets in recent years, including reaching an inflation rate of 2% to 3%. The bank believes wage growth of up to 4% is key to lifting inflation back to that target range.

“If [the RBA] continues to underperform, it means ongoing low wages growth … it means people stuck with larger mortgages that will take longer to pay off, meaning more people using their superannuation to pay off those mortgages,” said Shane Oliver, AMP Capital’s Chief Economist.

Housing debt to income ratio decreases

The ABS’s recent wealth report brings some good news, though. The report shows that the housing debt to income ratio slightly dropped, from 139.2 to 139.0 over the December 2020 quarter, as growth in income (1.2%) was greater than growth in housing debt (1.0%).

Over the year, the housing debt to income ratio fell 2.5%, the largest decline the ABS has recorded since 1990. The bureau attributed the recent growth in income to government stimulus schemes, including JobKeeper and the Coronavirus Supplement.

Total household wealth also went up, by 4.3%, the highest quarterly growth since the December 2009 quarter. Total household wealth and wealth per capita reached record levels of $12.03 trillion and $467,709, respectively. This should give many households a solid financial buffer to repay their debts.