If your small to medium-sized enterprise (SME) has performed solidly in recent years and you want that success to continue, you might consider budgeting for an increase in wages. That’s our conclusion after reading that an increasing number of SMEs are having trouble finding suitable people to fill jobs. That’s going to put pressure on wages, if it hasn’t already.

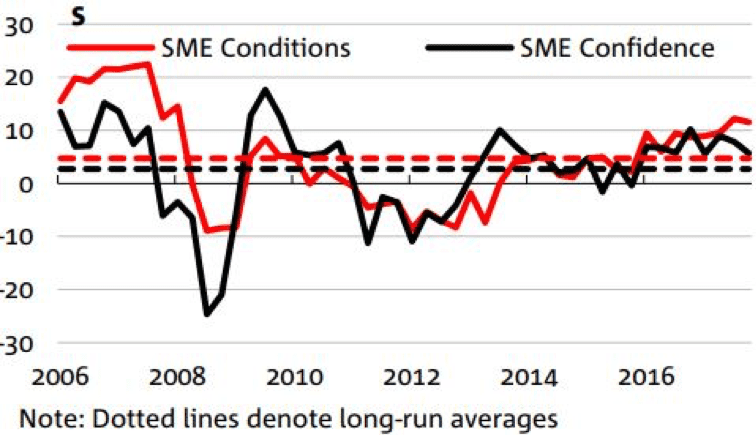

Australian SMEs have generally enjoyed reasonable business conditions, if you believe various industry surveys. In fact, SME business conditions in the first quarter of this year were the best since 2008, according to the National Australia Bank (NAB) Quarterly SME Business Survey, released in April this year. While there was a fall in employment and sales, profitability increased.

NAB reports that conditions were significantly better in Victoria than other mainland states, although they were also favourable in New South Wales and Queensland. Western Australia recorded the worst conditions, though conditions have been improving there during the last three and a half years. Business conditions for SMEs in South Australia fell for the first time since the third quarter of 2016.

NAB isn’t the only organisation reporting high levels of SME confidence. For example, the Sensis Business Index March 2018 survey, released last month, revealed the highest levels of confidence in the economy among smaller businesses since late 2010. Around 27 per cent of respondents told Sensis they thought the economy would be in a better position in February 2019.

Figure 1: SME business conditions and confidence

Skill Shortages

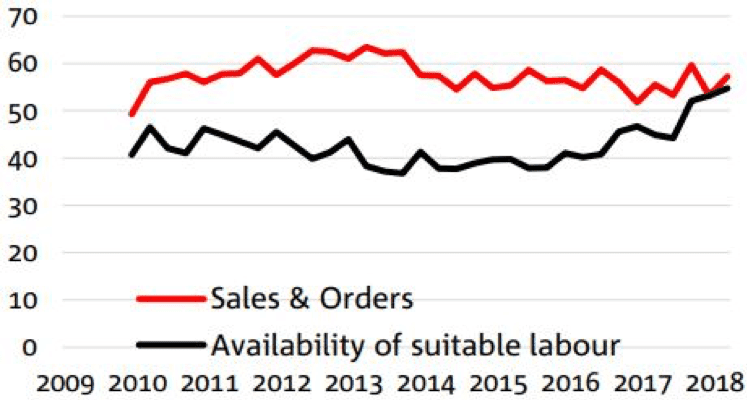

While industry reports about SMEs are upbeat, they also state that it’s getting harder to find suitable employees. This is a perpetual problem for any business, but NAB reports that it has worsened for SMEs in the last three years.

Those responding to the NAB survey said that a lack of suitable labour was the second biggest factor constraining their output, just behind a lack of sales and orders.

The Reserve Bank of Australia (RBA) has also commented on this trend. In February, Assistant Governor (Economic) Luci Ellis said signs of labour market tightening in business surveys indicated that “suitable labour is becoming increasingly difficult to find”.

Figure 2: Factors constraining SME output

Jobs site Seek examined this issue by looking at the number of job candidates across each sector using its site in 2016 and 2017. It found the largest decreases in the number of available candidates in the mining, resources and energy industry; the science and technology industry; and the trades and services sector.

At the other end of the scale, the number of available candidates on Seek’s site increased the most in the government sector; the advertising, media and arts sector; and the hospitality and tourism industry.

What Will This Mean For Wages?

Employers have created a lot of new jobs in Australia in recent years, but wage growth has been low. Has the time come to increase wages to attract more suitable job candidates?

SME owners might take comfort in the fact that wage predictions so far this year from industry observers have generally been conservative. That’s partially because there’s still spare capacity in the jobs market, which helps to keep wages down.

If they’ve made enterprise bargaining agreements, that might also keep wages down. In February, Luci Ellis said that recent enterprise agreements had generally resulted in a smaller wage increase than those they replaced.

SME owners could also try other methods of attracting and retaining employees. For example, Ellis said that companies were trying to retain staff members by offering them the opportunity to work extra hours, workplace perks and other benefits.

Still, more significant wage increases are inevitable. The unemployment rate declined in early 2018 and the federal government expects it to decline further and wages to increase. This month’s Federal Budget predicted the wage price index will increase from 1.9% in 2016–17 to 2.25% in 2017–18.

It will be interesting to see if SME confidence has changed when NAB releases its next quarterly SME survey in late July.