Australia’s housing market has returned to record highs after a year of a slight dip in values due to COVID-19. Commonwealth Bank now believes the market is on the “cusp of a boom” as lending rates rise sharply. It expects dwelling prices to climb 8% in 2021 and 6% in 2022, forecasting the values of houses and units to soar up to 16% and 9%, respectively, over these two years.

The bank had earlier predicted an 11% drop in home prices over the three years from 2020 in its base case COVID-19 scenario – and a 30% fall in its worst-case scenario.

This is great news for brokers. Ultra-low interest rates and growing confidence in the housing market will likely drive further demand and lending activity.

Exceeding previous peak

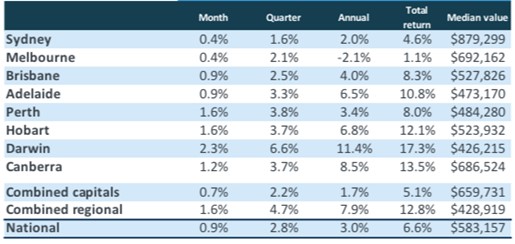

According to CoreLogic’s latest figures, housing prices across the country inched up 0.9% in January – 0.7% higher than the record sharp increase seen in October 2017.

Figure 1: Change in Australia’s housing values, January 2021

While the rise in values was broad based, prices in capital cities remain below their pre-COVID levels. In contrast, regional prices are now well above those levels, with values surging 6.5% since the onset of COVID-19 in March 2020.

“Near-term indicators of momentum suggest conditions will further strengthen,” said Gareth Aird, Commonwealth Bank’s Head of Australian Economics.

“Auction clearance rates are sitting at levels consistent with double-digit dwelling price growth,” he added. “The increase in new lending is now feeding into higher prices for bricks and mortar.”

Aird acknowledged that the pandemic’s impact was much milder than most forecasters predicted, including Commonwealth Bank. He attributed the recent rally in housing prices to the extremely low interest rates and a V-shaped recovery in the labour market.

“A critical assumption underpinning our forecasts is the cash rate remaining at its record low of 0.1%, which is in line with the RBA [Reserve Bank of Australia] forward guidance,” he said.

First home buyers drive demand

Based on recent government data, first home buyers are among those behind the pricing rally in recent months.

Figures from the Australian Bureau of Statistics (ABS) show that the number of loan commitments among owner-occupier first home buyers surged 9.3% to reach 15,205 in December 2020. This was a jump of 56.6% from a year ago and the highest level on record since June 2009, when the government tripled its first homeowner grant in response to the global financial crisis.

Figure 2: New housing loan commitments by purpose, December 2020

As Figure 2 shows, the value of new home loan commitments among first home buyers rose more than 14% in December to reach $6.5 billion.

“Federal and state government measures, such as HomeBuilder, and historically low interest rates are supporting ongoing growth in housing loan commitments,” said Amanda Seneviratne, ABS Head of Finance and Wealth.

The HomeBuilder scheme offers eligible owner occupiers, including first home buyers, a grant to build a new home or substantially renovate their existing home.

Prices could further surge

Housing prices are tipped to rise even more if the government relaxes responsible lending laws in March, as announced last year. Responsible lending rules require strict assessment of loan applications to ensure lenders give loans only to suitable borrowers.

Experts believe rolling back the laws would make it easier to get credit and increase the amount applicants could borrow. Ultimately, this would push housing prices up, according to Eliza Owen, CoreLogic’s Head of Australian Research.

“Even an acceleration at the rate in which credit flows into housing purchases could have added housing demand and put upward pressure on prices,” she said.