Spending expected to slow as higher interest rates bite

Hundreds of thousands of homeowners who took advantage of record low fixed-rate mortgages during the pandemic face a repayment cliff when their loans expire later this year.

This will see borrowers who secured fixed rates at around 2% after the Reserve Bank of Australia (RBA) lowered the official cash rate to a record-low of 0.1% in November 2020, move to considerably more expensive variable rates.

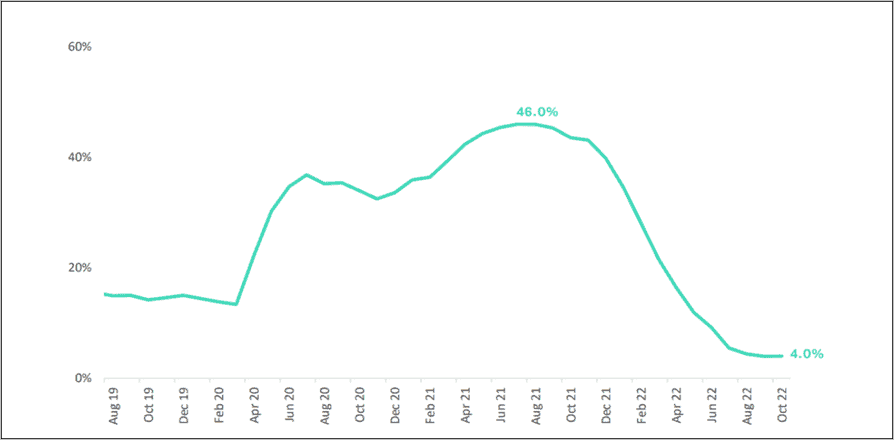

Fixed-rate loans represented 46% of all new lending in July 2021, up from around 15% prior to the pandemic (Figure 1).

Figure 1. Portion of new housing lending on fixed rates

Source: Australian Bureau of Statistics

The shift to higher variable rates for these fixed-rate borrowers comes on the back of ten official interest rates rises since May 2022, which have pushed the cash rate to a 10-year high of 3.60%.

While consecutive rate rises have already seen many variable-rate mortgage holders tighten their belts, the looming increase in repayments is likely to come as a shock for fixed-rate mortgage holders, according to KPMG analysis.

With the average new residential mortgage loan now around $600,000, KPMG Chief Economic Dr Brendan Rynne says “households still on fixed-rate mortgage interest rates will need to pay an additional $16,500 in interest payments, once they reset on to a variable-rate mortgage.”

According to RBA figures, more than 800,000 fixed-rate loans – worth about $350 billion – are expected to switch to variable repayments this year. When the change comes, most of these borrowers will likely face a 3–4 percentage point increase in their interest rate.

Mortgage stress increasing for households

With the official cash rate and interest rates tipped to increase even further this year, many households are finding themselves under considerable financial pressure.

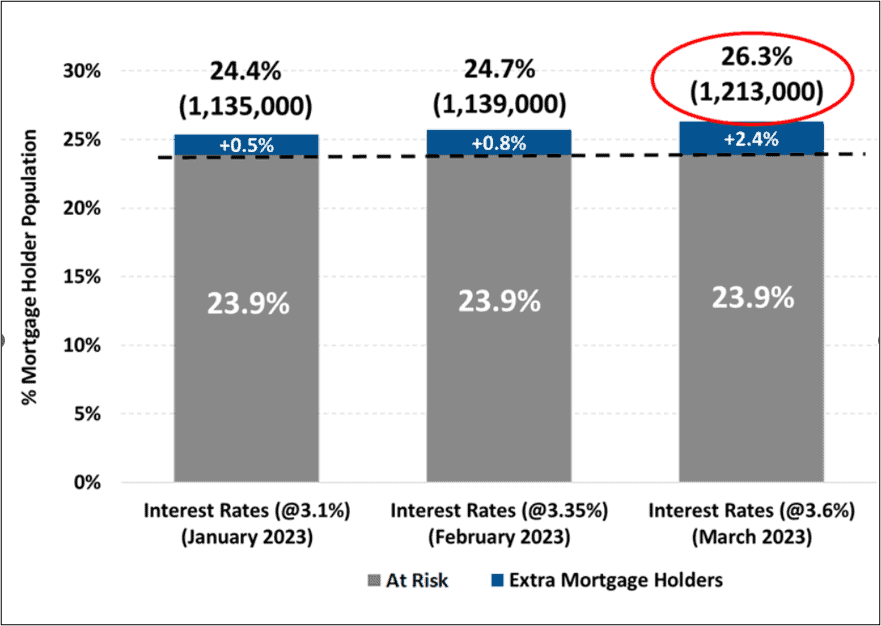

According to Roy Morgan research, almost a quarter of mortgage holders (23.9% or 1.1 million homeowners) were at risk of mortgage stress in the three months to December 2022, while 15% (666,000 homeowners) were classified as being extremely at risk of mortgage stress.

Mortgage stress is commonly defined as a homebuyer spending more than 30% of their disposable income on home loan repayments.

These numbers are expected to get worse, with Roy Morgan predicting that the number of mortgage holders at risk of mortgage stress will rise to 26.3% (1.2 million homeowners) in March 2023 if the RBA increases the interest rate again to 3.6%.

Figure 2. Mortgage risk as different levels of interest rate increases

Source: Roy Morgan Single Source (Australia), Oct–Dec 2022, n=3,550. Base: Australians 14+ with owner occupied home loan.

Meanwhile, a survey by financial comparison site Finder.com.au revealed one in eight (13%) mortgage holders have skipped a repayment in the past six months, equivalent to 429,000 households. Of those, 6% had missed multiple payments.

Despite the distress many households are already under, the RBA insists further rate rises are necessary.

“The bank understands that some people are finding the rise in interest rates difficult to manage and others will have to cut back on discretionary spending,” said Marion Kohler, Head of Economic Analysis Department at the RBA, speaking at the senate select committee on the cost of living recently.

“However, higher interest rates are necessary to ensure that the current period of higher inflation and cost-of-living pressures does not persist too long.”

Economic activity could slow more than expected

If the RBA forges ahead with another three rate rises of a quarter of a percentage point over the next six months, as some financial analysts fear, the effect on the Australian economy could be more extreme than the RBA expects.

“It would not be unreasonable to expect house consumption expenditure to be about $20 billion lower as a direct result of the monetary policy tightening, which would have the effect of reducing GDP by around 1%,” Dr Rynne says.

This sharp contraction in household spending could pull the economy into recession, potentially increasing the number of forced home sales and reducing demand for new home loans.

“It would seem the RBA’s forecasts are optimistic and once the effects of higher interest rates flowing through to higher rents and the full impact of real wage losses are factored in, then the slowdown in economic activity over the coming year is likely to be even more acute than even these updated forecasts by the RBA suggest,” concludes Dr Rynne.