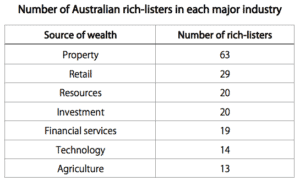

Australian property developers seem to be surviving the housing slump quite well. According to The Australian Financial Review 2019 Rich List, property remains the most common industry for those featured in the annual ranking of Australia’s 200 wealthiest individuals. Indeed, there are now 63 property rich-listers, up from 51 last year.

Despite a recent NAB report that declared the retail sector “clearly in recession”, success in retail has also propelled markedly more individuals to this year’s rich list – there are now 29 rich-listers from retail, up from 22 last year. Resources, investment and financial services also continue to spawn rich-listers.

However, the trajectory of one group is most noteworthy of all.

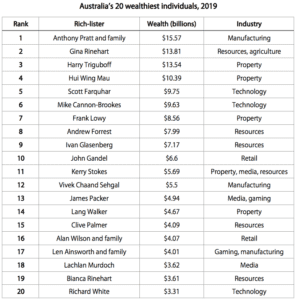

Technology entrepreneurs are growing their wealth faster than other rich-listers, according to the AFR. Atlassian co-founders Scott Farquhar and Mike Cannon-Brookes, for example, grew their estimated wealth from $5 billion each in 2018 to more than $9 billion each this year, the largest jump in absolute terms of anyone featured. This elevated them into the top 10 for the first time, in fifth and sixth spots. The duo only debuted on the rich list in 2013 and were then near the bottom rungs in 190th and 191st places.

Another tech billionaire, Richard White, founder of logistics software provider WiseTech, grew his wealth by more than 99% over the past year to $3.31 billion, moving him up from 44th to 20th spot. He was new to the rich list as recently as 2016.

Seven other tech entrepreneurs landed on the rich list for the first time. They include Nick Molnar and Anthony Eisen, founders of Afterpay, and Kayla Itsines and Tobi Pearce of the fitness app Sweat.

Technology now accounts for a total of 14 individuals on the list. This may seem small, considering that the first Australian tech entrepreneur debuted more than 20 years ago. But in an economy still dominated by traditional industries such as property and resources, this is already a record number and is only likely to increase.

More billionaires

The club of Australian billionaires has grown considerably – from 76 in 2018 to 91 this year.

Together, Australia’s 200 richest individuals control $341.8 billion in wealth, a rise of 21% from last year.

This means that the country’s wealthiest had to be richer to make it to the list. Specifically, they needed to have at least $472 million – up from the $387 million belonging to the ‘poorest’ person on last year’s list. This led to the exclusion of famous names such as vitamins tycoon Marcus Blackmore, Temenos founder George Koukis and actress Nicole Kidman.

Familiar faces

Long-time rich-listers Anthony Pratt (manufacturing), Gina Rinehart (resources and agriculture) and Harry Triguboff (property) remain in the top three spots. Together, they hold nearly $43 billion in wealth.

Pratt’s estimated wealth of $15.57 billion made him Australia’s richest individual for the third year in a row. The AFR attributes the 20% surge in his wealth largely to President Donald Trump’s corporate tax cuts in the US, where Pratt’s company has extensive operations.

“[Trump’s] slashing of the corporate tax rate and granting of instant write-offs for business investment has bolstered the bottom line of Anthony Pratt,” said AFR Rich List editor Michael Bailey.