Back in April, predictions for Australia’s housing market were dire. Home prices were expected to plunge by as much as 30% as COVID-19 restrictions took their toll on the property industry. Now, data shows the market has largely held out.

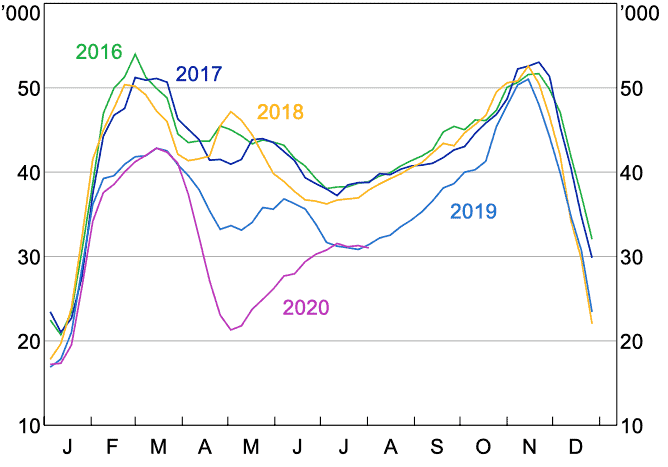

Housing prices in most capital cities have declined only slightly since May, according to the Reserve Bank’s August statement on monetary policy. While Melbourne has recorded significant falls, prices in Adelaide, Canberra and Hobart have held up. The central bank also cited Sydney’s new residential property listings, which despite tumbling in April, have bounced back in July.

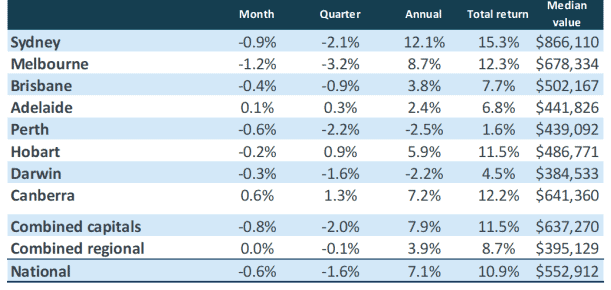

Data from CoreLogic shows that Canberra and Adelaide saw an increase in housing values over July, while Melbourne and Sydney showed the largest declines with -1.2% and -0.9% respectively. Across Australia, housing prices dropped 0.6%, following June’s 0.7% fall.

Figure 1: Change in housing values, July 2020

According to CoreLogic Head of Research Tim Lawless, housing prices have been resilient despite the havoc of the COVID-19 pandemic. National home values have fallen only 1.6% since April, and housing turnover has recovered after a sharp fall in late March and the following month.

“Record low interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn,” says Lawless.

Figure 2: Movement in new residential property listings

A rise in housing stock

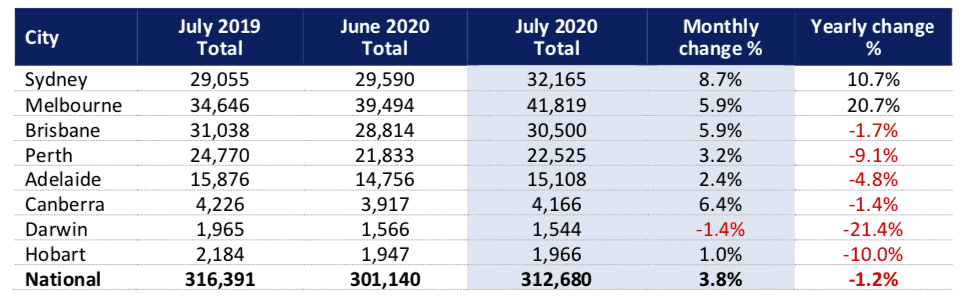

While Sydney’s level of new property listings in July was similar to last year’s, total stock on the market increased more than 10% year on year, according to data from SQM Research. Melbourne recorded an even bigger rise in total listings at more than 20% on the previous year. All other capital cities posted annual declines.

Figure 3: Total residential property listings in July 2020

SQM Managing Director Louis Christopher considers it ‘somewhat abnormal’ to see rises in listings during winter. “Normally, falls are recorded,” he says. “This could have been generated by the lifting in restrictions over May and June, enticing sellers to the market.”

He believes the marked increases recorded in Melbourne and Sydney point to softening market conditions.

“Such a reading normally is associated with a weakening market and no question, this is what is occurring in our two largest cities,” says Christopher. “Outside the two capital cities, the market is more balanced and indeed, we are seeing an increase in demand for housing across regional Australia.”

Uncertainty ahead

General conditions in the new housing market are also weak, according to the Reserve Bank. This is despite the recent introduction of HomeBuilder, a scheme that gives eligible owner-occupiers a $25,000 grant to build a new home or extensively renovate an existing property.

“Construction activity in Melbourne will be significantly curtailed by restrictions on the number of workers allowed on residential construction sites in August and September,” says the central bank.

And as government stimulus schemes start to taper off in October, Lawless believes the medium-term outlook for the housing market remains skewed towards a downturn.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” he says. “Similarly, the recent concerns of a second wave of the virus and the potential for renewed border closures and stricter social distancing policies are likely to further push consumer sentiment down. This is likely to weigh on both home buying and selling activity more broadly.”