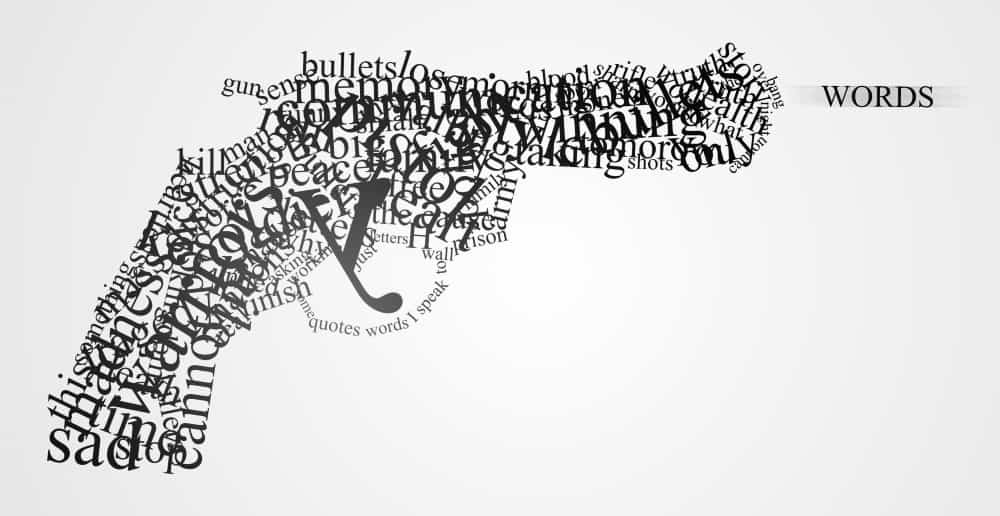

Jawboning, or trying to influence markets through pointed commentary, is one of the weapons financial regulators use to supplement their policy tools.

It’s been popular for a long time. Central banks use it in their board reports, which are pored over by people in the markets, and in speeches by their executives.

But when politicians start trying the same thing, they generally just cause alarm. They are like tourists strolling unwittingly into areas where they may be mugged.

Making a statement

Former Federal Treasurer Peter Costello was a big fan of jawboning. He used it often to do such things as trying to stop the banks lifting their interest rates and for getting stuck into Telstra. He had some bruising encounters.

Now Prime Minister Malcolm Turnbull has also had a crack.

“Monetary policy remains accommodative and will stay that way for a while yet, but it means that [interest] rates are more likely to go up than down,” Turnbull told an economic conference in Melbourne. “Asset prices can move in two directions – down as well as up.”

The official cash rate

He was warning that cheap money won’t last forever and real estate prices will fall once interest rates start to rise. But he risked doing some collateral damage with his remarks as they followed a statement from the Reserve Bank of Australia (RBA) after its monthly meeting that the so-called ‘neutral’ official interest rate should be 3.5%.

The rider was that this should be the level if the economy returned to good health. The current official interest rate is 1.5%.

Dollar spikes

The combination of the two statements sent the Aussie dollar into overdrive on the expectation that the RBA would increase interest rates sooner rather than later.

It was up to RBA Deputy Governor Guy Debelle to get the fire hose out.

“No significance should be read into the fact the neutral rate was discussed at this particular meeting,” he said later. “Most meetings, the board allocates some time to discussing a policy-relevant issue in more detail, and on this occasion it was the neutral rate.”

Then RBA Governor Philip Lowe added that because full employment was some distance off, any rapid increase in wage and inflationary pressures – and by inference a rate rise – was unlikely.

Average earnings per hour

Year-ended growth, four-year moving average

The latest inflation figure bears that out, coming in below the 2–3% target band the RBA tries to maintain through monetary policy adjustments.

After Lowe’s speech and news of the low inflation figure, the futures market – which punts on the likelihood of future events – discounted the possibility of a fully priced rise until September 2018.

The real experts

Which brings us back to the Prime Minister’s efforts to cool the housing market.

Perhaps Turnbull’s warning to potential home buyers will stop a few of the unsophisticated ones, but for the most part those who listen to what the real experts are saying won’t take a blind bit of notice. The greater risk is that we all get mugged by the rising dollar.