Australia’s house prices have gone through the roof – and there seem to be plenty of reasons they will stay that way for a while.

According to the Real Estate Institute of Australia, the median price for Australian houses jumped from $160,000 in 1996 to $825,000 in 2020. And over the past five years, it rose from $683,000 to $825,000.

While other dwellings such as units didn’t see as much growth, their values rose all the same, climbing by about 400% over the last 25 years and 10% over the past five years.

Rises in dwelling values will likely be even more remarkable this year. ANZ, for example, now expects house prices to soar 17% in 2021 after forecasting them to increase by 9%. Prices across the country increased 6.8% in the three months to April 2021 compared to the previous quarter.

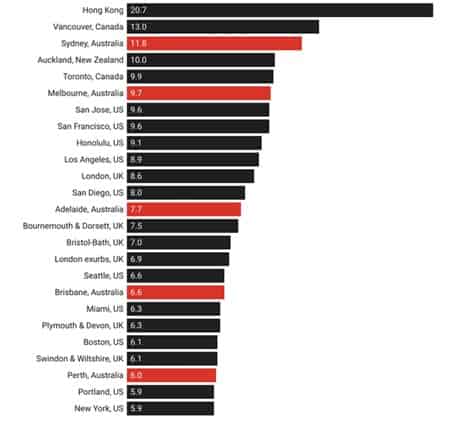

Not surprisingly, housing affordability is again at the forefront of public debates as properties in capital cities such as Sydney and Melbourne become even more expensive. As Figure 1 shows, houses in both Australian cities are much more unaffordable than in other metropolitan areas such as San Francisco and London.

Figure 1: 25 most unaffordable metropolitan areas in eight countries (September 2020 quarter)

Note: The rankings are based on the price-to-income ratio of median house prices divided by gross median household income.

Source: The Conversation using data from Demographia International Housing Affordability Survey 2021

Factors driving price increases

Today’s ultra-low mortgage interest rates are a key driver behind the recent surges in housing values. For many Australians, the ability to fix their loans for up to five years at very low rates is just too tempting to resist.

“Clearly, very low interest rates have more than offset the headwinds from higher unemployment and low population growth,” says ANZ Senior Economist Felicity Emmett.

Perhaps equally important is the rebound in consumer confidence, buoyed by the strong economic recovery from COVID-19.

According to the Westpac-Melbourne Institute Index of Consumer Sentiment, confidence among Australian consumers reached an 11-year high at 118.8 in April this year, up from 111.8 the previous month. Westpac Chief Economist Bill Evans calls it “an extraordinary result”.

“The index is now at its highest level since August 2010 when Australia’s post-global financial crisis rebound and mining boom were in full swing,” says Evans.

Stimulus programs and FOMO

According to Economics Professor Richard Holden, the prospect of most Australians being vaccinated and international borders reopening offers further hope for many.

“The federal government has contributed, too, with a suite of measures targeted at first home buyers,” he adds. “Like all such measures, these look attractive at the individual level but simply translate into higher prices. Schemes like the ‘first homeowner grant’ should really be called the ‘seller subsidy’.”

Other stimulus programs include the HomeBuilder grant, the JobKeeper scheme, and mortgage deferrals by banks.

A mismatch between supply and demand has also pushed up prices.

“Housing inventory is around record lows for this time of the year and buyer demand is well above average,” says CoreLogic Research Director Tim Lawless. “These conditions favour sellers.”

Then there’s the fear of missing out. Aside from driving exuberant potential buyers to the market, FOMO limits their ability to negotiate prices, notes Lawless.

“Who knows how much fear of missing out has played into price rises,” says Holden. “Against the backdrop of a worldwide public health and economic crisis, one might think buyers would be a little more circumspect about their future incomes. But apparently not so much.”