Recent declines in the retail environment and the market’s constant focus on European financial instability have weighed on investor sentiment in the commercial property sector and, according to recent surveys, these sentiment levels have reached their lowest point in two years. The latest example of this pessimistic trend can be seen in the Commercial Property Index, released by the National Australia Bank, which dropped to minus-16 in the second quarter (a sharp decline from the minus-8 reading seen in the first quarter). Below we can see the report (along with future expectations), divided into several key categories. Note the declining expectations in each of the major property segments:

Overall, these are the lowest figures since the NAB began collecting its data, so consumer confidence continues to be one of the biggest challenges property firms are likely to face into the end of this year. Most of the pessimism was seen amongst professionals in the Retail Advertisement and Industrial Property space, which is likely a reflection of the broader trends seen in those areas of the economy.

Factors Affecting Demand

Traditional retailers have experienced spotty demand levels in the last few years, as weaker consumer confidence has exacerbated increased competition from foreign retailers. This trend picked up significantly as the Australian Dollar rose relative to its commonly traded counterparts (making foreign items less expensive for consumers). In addition to this, we have seen profit warnings from several major retailers (eg Myer, Harvey Norman and David Jones) prior to releasing corporate earnings statements.

Some analysts have drawn a connection between the weaker commercial property sentiment and the declines seen in housing construction figures, which are lower now than they were in the 1990s. But on the positive side, the NAB report also showed that under-supply in the office and industrial markets is likely to emerge in the next 3-5 years as lower interest rates and an improving global economy helps property demand to rebound from the sluggish environment seen at the moment.

Strategies for Increasing Property Returns

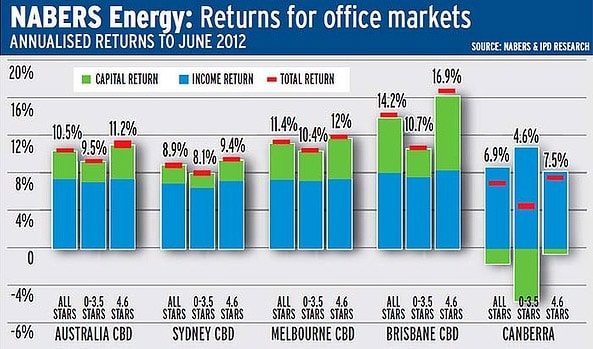

While market optimism is difficult to locate in some cases, central bank efforts (such as the decrease in interest rates of 125 basis points since last November) and new property development strategies have been introduced in some areas in order to increase profitability. Specifically, recent reports have shown that green office buildings located in Australian CBD markets have produced enhanced investment returns. The Melbourne and Brisbane markets were the best indication of these results, as a report from the DEXUS Property Group assessed commercial buildings using a 6-star National Australian Built Environment Rating System (NABERS) to determine potential profitability strategies in 32 Australian districts.

Green development projects beat the returns seen in the broader office market in both the Sydney and Melbourne CBDs, propelled by increased growth in total asset values.

NABERS energy buildings with the highest ratings (above 4 stars) consistently outperformed returns seen in lower-rated buildings (below 3.5 stars) in each major city, propelled by strong capital growth driven investment returns.

Tenants tend to prefer buildings with higher environmental energy ratings, helping to increase effective rental prices and total asset values.

Looking at profit performances to June of this year, highly-rated buildings in Melbourne produced annualised returns of 11.9%, which is a full 100 basis points higher than the index’s All-Office return of 10.9%. This stronger performance was aided by capital growth of 4.2% in the region. Profit returns were even stronger in Sydney, with highly-rated buildings outperforming the broader market by nearly 3%.

With capital growth of 6.3% in Sydney, the report showed that highly-rated buildings consistently generated enhanced investment returns relative to their lower-rated counterparts. With all of these factors in mind, investors are clearly positioning themselves to benefit from social trends (along with more attractive interest rate levels) to help counter some of the negative sentiment seen this year in Australian property demand.