The housing market has lost steam after two years of breakneck growth. Dwelling values in select suburbs had already dropped by as much as $200,000 in the three months to April, as interest rates begin to rise along with the cost of living.

For small business owners looking to borrow using their home equity, this might be a good time to work with a mortgage broker to get a better interest rate.

The PropTrack Home Price Index shows national housing prices grew 0.13% in April. This was the slowest monthly increase since May 2020, with Sydney and Hobart recording their first monthly declines since the start of the pandemic housing boom.

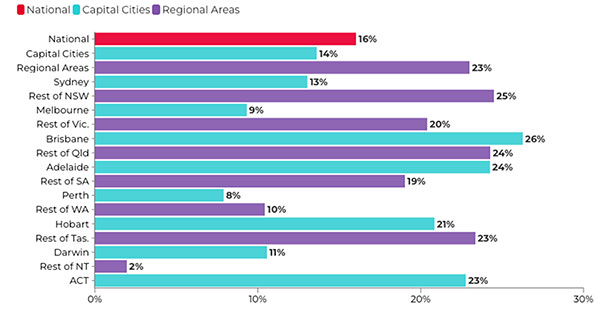

The housing market grew 16% in the year to April, about the same rate as a year ago.

Figure 1: Australian housing market annual growth, April 2022

Source: PropTrack Home Price Index, April 2022

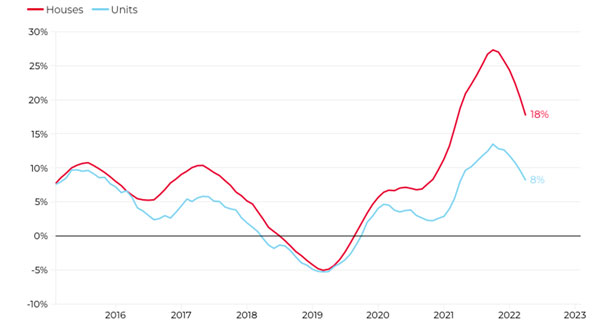

Figure 2: Price growth of houses and units

Source: PropTrack Home Price Index, April 2022

The slowdown is not surprising, according to PropTrack Economist Angus Moore, adding that housing market growth has lost its momentum.

“Prices were up 35% since the pandemic began, and we were never going to maintain that growth.”

Pricey suburbs lead price falls

Another report reveals that expensive inner-city suburbs are leading the broader decline in prices. Housing values in Sydney’s Beaconsfield fell 8.5% or $168,000 in the three months to April. In Darlinghurst, they dropped more than $206,000 or 8.3%.

Declines are more modest in Melbourne suburbs. In Park Orchards, prices fell 7.1% and in Balaclava 5.1%.

“Higher income households tend to hold more housing debt to income, so do property investors,” says CoreLogic Head of Research Eliza Owen.

“That’s why the high end of the market can often be more sensitive to changes in interest rates or credit conditions, but this can also affect some other popular investment markets like inner-city areas.”

Further declines likely

The April slowdown came just before the Reserve Bank of Australia lifted the official interest rate for the first time in more than 10 years.

This suggests that further price falls are likely as expected rate hikes make it difficult for some borrowers to meet mortgage repayments.

Based on its May 2022 survey of property analysts, Reuters expects Australian housing market growth to slow to just 1% this year. This is down sharply on the 6.7% it forecast after its February 2022 poll.

However, it predicts prices to drop 8% next year, more than the 5% forecast after its February survey.

“A steep increase in mortgage rates over the coming year will weigh heavily on house prices,” says ANZ Senior Economist Adelaide Timbrell, one of Reuters’ respondents.

Westpac also expects dwelling values to drop 8% in 2023, but it expects them to fall at a higher rate of 2% this year. The bank based its forecasts on an expectation that the official interest rate would rise to a peak of 2.25% by May 2023, up from 0.35% now.

Market conditions have already turned, according to Westpac Senior Economist Matthew Hassan.

“Sales are down sharply from last year’s extreme highs, buyer sentiment is plumbing new cycle lows and house price expectations are being pared back quickly,” says Hassan.

But Housing Industry Association Chief Economist Tim Reardon doesn’t expect price falls to be as substantial as some observers predict.

“As interest rates increase, the high growth cycle will stall and we’ll enter a different cycle where prices will decline,” he says. “But it’s difficult to see house prices falling significantly while we still have a shortage of supply.”