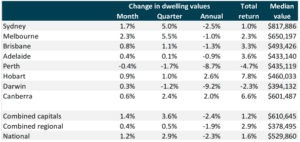

Housing prices are rising again. In October, national home values rose 1.2%, the largest monthly increase in more than four years. Home values in Sydney and Melbourne had recovered 6% and 5.3% respectively since the housing market bottomed out in May 2019, according to CoreLogic.

This is good news for homeowners, investors and particularly for business owners who have taken out loans using equity in their homes. But what’s driving this pickup in prices? And is it sustainable?

Figure 1: Australian home values as at end of October 2019

The Election Factor

One theory is that the rise is partly thanks to the Coalition Government’s win in the May federal election, signalling continuity and less uncertainty in the property market.

“It’s likely that buyer demand and confidence is responding to the positive effect of a stable federal government, as well as lower interest rates, tax cuts and a subtle easing in credit policy,” said CoreLogic Research Director Tim Lawless.

Before the election, the Labor Party proposed halving the capital gains tax discount and limiting negative gearing to new homes to help improve housing affordability. According to some analysts, a Labor win would have adversely affected property markets and led to cooling prices. SQM Research, for example, estimated that such policies would have led to capital city home prices falling up to 12% by 2022.

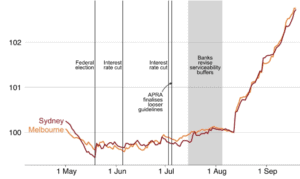

While the election results might be a factor in the rise, it’s important to note that home prices did not go up immediately after the election. Data from the Grattan Institute shows that though they climbed 0.14% collectively in Australia’s five largest cities right after the election, they then remained stagnant for the next three months.

“If the election result had a big effect on prices, it certainly took its time to show up in the data,” the Institute’s Brendan Coates and Matt Cowgill wrote in a recent blog post.

Figure 2: House price movement in Australia’s five largest cities, 2019

Price Increases After APRA Move

A likely bigger contributing factor to the recent price surge is that banks have started loosening their serviceability requirements following a rule change. The Australian Prudential Regulatory Authority (APRA) relaxed its guidance on banks’ serviceability assessment in July 2019. Previously, it had required banks to assess applicants’ ability to pay back home loans by using interest rates of 7% or more. From July, banks have been able to set their own minimum rate floor, with a buffer of at least 2.5% above the loan’s interest rate.

APRA introduced the serviceability guidance in late 2014 as a part of a package of rules to strengthen home lending standards. But as banks tightened their requirements, credit became increasingly out of reach for would-be borrowers, particularly in Sydney and Melbourne. Many property observers blamed this for the housing slump that started in late 2017.

The rule change has increased borrowing capacity by 10% to 15%, and since August, home prices have soared in Sydney and Melbourne, according to Coates and Cowgill.

“If sustained, the pace of current increases would see double-digit annual house price growth in Sydney and Melbourne over the next year,” they said in September.

Figure 3: House price movements in Sydney and Melbourne after a rule change

Supply Also A Driver

Limited housing supply could be another driver of the recent rebound in prices. As Reserve Bank Governor Philip Lowe pointed out in a speech in March, the recent correction in prices had its origins in housing supply’s inability to meet demand as population growth surged. Australia’s population grew markedly in the mid-2000s, but it took nearly 10 years for the rate of home building to catch up with demand.

With housing construction now contracting, some economists believe limited supply is pushing prices up.

“The recent bounce back in house prices in Sydney and Melbourne looks like it’s a result of limited supply and a move by owner-occupiers to enter the market,” said Sarah Hunter of BIS Oxford Economics in a recent interview.

Data from the Australian Bureau of Statistics shows that the value of residential construction work done dropped 8.7% year on year in the June 2019 quarter, in seasonally adjusted terms. Westpac economists expect housing construction to contract by 11% in 2019 and a further 8% in 2020.

What’s Next?

As prices go up, economists have been quick to come forward with new projections on how much home values will rise and whether Sydney and Melbourne can sustain their pace of price growth.

Westpac expects prices in Sydney and Melbourne to increase by around 12% by the end of 2020 from their lows in May 2019. AMP says price recovery will likely be muted.

“Our assessment remains that after a further bounce, price gains will be constrained through next year due to still tighter lending standards, unit supply, slow growth and rising unemployment,” AMP Capital Chief Economist Shane Oliver said in a recent interview.

Low interest rates should help drive house prices up over the next few years. The Reserve Bank cut the cash rate by 0.25% in early October, bringing it to a record low of 0.75%.

“If the Reserve Bank cuts rates by a further 50 basis points in the coming months, as markets expect, prices could be 8% higher than otherwise,” said Coates and Cowgill shortly before the October rate cut.