Now that the federal election is over and the Labor Party’s planned changes to negative gearing and capital gains tax are off the table, what happens to house prices next? Is the market correction nearing its end?

If we are to believe the more optimistic views in recent weeks, it is. According to Commonwealth Bank senior economist Gareth Aird, the bottom of the housing market is “just around the corner”. Similarly, HSBC Australia’s chief economist Paul Bloxham said the market would stabilise by the second half of 2019, as housing data shows signs of improving.

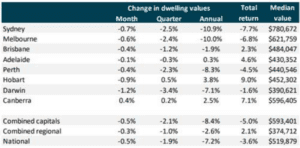

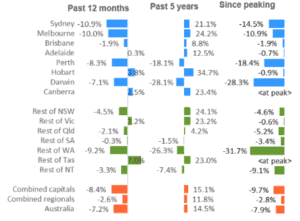

Data from CoreLogic reveals that the rate of decline in house prices has been easing since December 2018, even though national prices continued to fall in April 2019. Home values across the country fell by 0.5% over the month, less than the 1.1% decline in December 2018. As of April, national housing prices have tumbled by 7.9% since their peak in September 2017.

Table 1: Australian housing index as at 30 April 2019

Table 2: Change in Australian home values since peaking in September 2017 (as at 30 April 2019)

This, along with other recent property market data, suggests that the housing market “may have moved through the worst of the downturn”, said CoreLogic head of research Tim Lawless. Other data indicates an increase in mortgage-related valuations activity, an improvement in recent household finance data, and auction clearance rates holding at around mid-50% across major markets.

While these are important indicators, people looking to buy or sell property have to keep in mind that housing trends continue to change. So what are the key factors they must keep an eye on?

Credit environment

Tighter credit has contributed greatly to price falls since the Australian Prudential Regulatory Authority required banks to review and bolster their serviceability metrics. Because this measure is meant to strengthen lending standards and minimise risks to the financial system, economists don’t expect Australia to go back to a time when the market was awash with cheap credit.

Interest rates and home supply

Interest rates are another factor. Many economists expect the Reserve Bank of Australia (RBA) to cut the official cash rate. As the unemployment rate climbs, the RBA has lowered its economic growth forecast for 2019 from 3% to around 2.75%. The cash rate is largely predicted to sit at around 1% by the end of 2019.

Interest rate cuts have historically lifted property prices. But this time the impact would be softer because housing conditions have changed since the last cut in 2016, according to Trent Wiltshire, an economist at property portal Domain.

“Most notably, stricter bank lending rules mean lower rates will not allow potential borrowers to get more finance,” he said.

Still, Wiltshire believes lower interest rates will support housing prices. “In cities like Sydney and Melbourne, a cut will likely mean either a slowing or an end to price falls, while in cities like Hobart and Canberra, a cut may provide a boost to price growth.”

Housing supply also affects prices considerably. A strong surge in the supply of new homes, particularly apartments, is contributing to the ongoing price fall, according to AMP Capital senior economist Diana Mousina.

Threats are abating

While these factors continue to influence house prices, some “threats to property” are beginning to subside, according to Shane Oliver, AMP Capital’s chief economist.

“Affordability has improved … and the uncertainty about negative gearing and the capital gains tax has been removed,” said Oliver in a recent report.

He doesn’t expect credit tightening to get significantly worse, and considers the absence of panic selling a positive for the market.

Oliver had previously forecast housing prices to bottom out in 2020, but now expects that a plan to support first homebuyers will help bring this forward.

In May, the Coalition Government unveiled a scheme to support first homebuyers. The First Home Loan Deposit Scheme will help those earning up to $125,000 a year ($200,000 for couples) get a loan with a 5% deposit from January 2020.

“The fact support is on the way for first homebuyers … along with RBA interest rate cuts, means the market could end up bottoming [out] sooner,” said Oliver.