The RBA has held the cash rate steady at 3.60 per cent, maintaining its cautious stance as inflation edges higher and housing demand continues to grow.

The decision was announced after the November board meeting. At a post-meeting press conference, Governor Michele Bullock reiterated that inflation remains above target and that the Bank needs further evidence of moderation before considering any policy changes.

Bullock also confirmed that a rate cut was not a consideration this month. “We have already had three interest rate cuts,” she said. “I know mortgage holders always want more but it’s also important that we make sure that we keep inflation under control because ultimately that’s also what impacts people’s living standards.”

Inflation remains above target

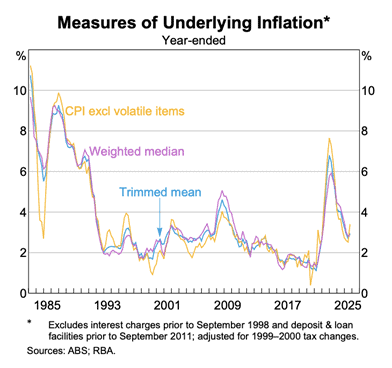

After several months of gradual decline, inflation has shown signs of persistence. The trimmed mean — the RBA’s preferred measure of underlying inflation — rose to 3.0 per cent over the year, up from 2.7 per cent in June, while headline inflation reached 3.2 per cent.

“Just below three is not good enough for the Board,” Bullock told reporters. “We need to be confident that inflation is sustainably within the 2 to 3 per cent range before adjusting policy.”

Recent data presents a mixed picture, reinforcing the RBA’s cautious stance. Goods inflation continues to ease, but price pressures in services remain elevated, adding uncertainty to the pace of disinflation. Housing and rental costs remain key contributors, alongside higher prices for household services. Unemployment, while remaining near multi-decade lows, has recently edged up to 4.50%.

Sources: Australian Bureau of Statistics; Reserve Bank Australia, Chart Pack

The Bank expects underlying inflation to stay above 3 per cent over the coming quarters before gradually easing to around 2.6 per cent by 2027.

Plateau after rapid tightening

The RBA’s holding pattern follows one of the fastest tightening cycles in recent history. After 13 rate increases between May 2022 and March 2024, and 3 cuts this year, the Bank has now paused for 5 consecutive board meetings.

Bullock said the Board would be carefully monitoring any further impact on consumption from the cuts earlier this year.

“The bulk of [those cuts] has yet to come through in terms of its effect on the economy. So we’ll be watching that to make sure that it doesn’t feed through too much into consumption and ultimately consumption that can’t be met by supply,” she said.

Viewed over the longer term, the current environment is unusual. For much of the past decade, interest rates remained at record lows, briefly approaching zero during the pandemic. The recent increases have lifted borrowing costs to their highest level since 2012.

Source: Reserve Bank of Australia, Cash Rate Target

The current pause reflects the Bank’s desire to balance inflation control with economic stability, assessing how earlier hikes continue to flow through household spending, housing demand and business investment.

Markets scale back expectations

The persistence of inflation has reshaped market sentiment. Financial markets had largely anticipated the November hold, though some investors had priced in a small chance of a Cup Day cut.

Economists at several major banks, including Commonwealth Bank and ANZ, say the cash rate is likely to stay at its current level well into 2026. Futures markets also indicate a lower probability of cuts in the next twelve months.

ANZ’s head of Australian economics, Adam Boyton, believes that a final 25bp cut is possible in the first half of 2026, though potentially later than initially forecast. “There is a risk that the final rate cut we expect in February could end up occurring later (possibly May, after the next two quarterly CPIs),” said Boyton.

Chief economist at the Centre for Independent Studies, Peter Tulip, echoed this with a message to borrowers. “If you were planning on buying a house and had the expectation of lower mortgage rates, then you need to reassess your plans,” he said.

Growth outlook and forward view

The challenge now is to sustain economic momentum without reigniting inflation. The RBA noted that domestic demand continues to expand modestly, supported by population growth and business investment. While growth has moderated, the economy remains resilient: output and employment are above pre‑pandemic levels, and business credit growth has stabilised.

Looking ahead, the RBA’s forecasts suggest inflation will remain the main constraint on monetary policy over the next year. With global uncertainty persisting and housing costs continuing to rise, the Board is expected to maintain its cautious stance.